What would you do if you suddenly lost your income?

As we all know, there are some things that are out of our control.

For instance, during the last American federal government shutdown, employees had — NO PAYCHECK FOR 5 WEEKS!!

And that sent many federal workers into full-blown crisis mode!

Why? Because it dramatically highlighted the fact that so many Americans are not prepared for a rainy day.

In fact, 75% of all workers admitted that they are living paycheck to paycheck.

Mind-blowing, isn’t it?

But what’s worse, is that they also have no backup plan for emergencies!

And unfortunately, even when you don’t get paid...bills keep coming!

So it’s crucial to start building your cash cushion right now!

Table of Contents

Do You Need An Emergency Fund?

The short answer is…ABSOLUTELY!!!

Because, as it turns out, 40% of Americans can’t even cover a $400 emergency! That is, without needing to borrow money!

On top of that, I have heard so many people say that they barely earn enough to pay all their bills.

Obviously, that makes it next to impossible to save money, right?

So where does that leave you? In a sticky situation, that’s where!

And you’re pretty much left with only 3 options:

- Using credit cards

- Taking out personal loans

- Or begging from family and friends.

But, here’s the downside to all those options:

1. The average credit card rate is about 17.5%. And chances are that you’re only making the minimum payments.

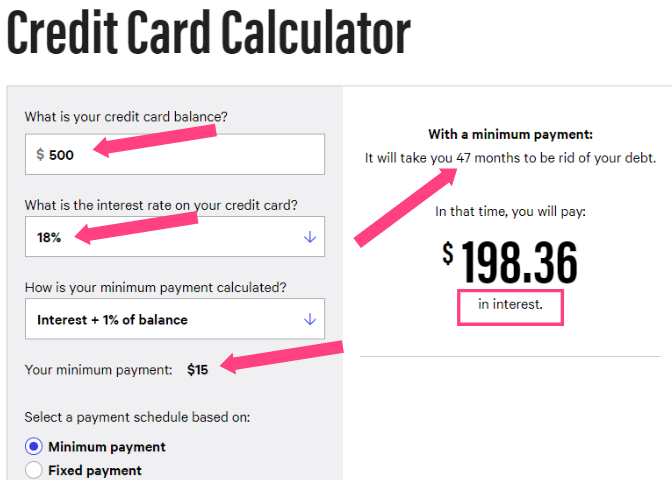

Now, look at this example of how paying the minimum balance on just $500 can hold you hostage for years!

What’s even more frightening is the dreaded cash advance. Avoid them at all cost!

Cash advance rates on credit cards can run as high as 30%.

Now, can you even imagine how many years you’ll be paying for that?

Scary!

Do yourself a favor and check out this credit card calculator.

It will show you the shocking truth about just how severely credit cards are draining your finances.

And that’s precisely why I wrote the following 3 posts:

*5 Reasons Why I Still Respect The “B” Word And So Should You.

*3 Super Smart Strategies To Prepare For Unexpected Expenses.

*3 Money-Sabotaging Chains That Hold Your Finances Hostage.

They all go a little deeper into the money mindset. And they provide great strategies to get you on the right track with your finances.

2. Borrowing money from family and friends is a slippery slope!

And if you don’t want it to damage your relationship, then you need to treat it like a business arrangement.

That means, set up real terms regarding how much you can pay back and when!

In addition to that, you must BE RESPONSIBLE ABOUT PAYING BACK just as if it’s a bill that you owe.

Because guess what? It is!

And believe me, they won’t forget that you owe them!

3. Now, on the other hand, Personal loans may offer lower interest rates IF you have good credit!

But, more than likely, if you’re not good with saving money, then you’re probably also not good with managing credit.

And that means you won’t qualify for the lowest interest rates of about 5%.

Instead, you’ll end up with rates anywhere from 15%-30%. OUCH!

Sadly, that’s not a good option either, just refer back to the payment calculator!

So what’s left?

Well, the bottom line is, that you’re going to have to force yourself to create an emergency fund ahead of time!

And the good news is…that it is doable even on a tight budget!

Best of all, you won’t find yourself in a financial crisis, stressed out and scrambling to find money!

What is the Average Emergency Fund?

So, how much money do you need to be prepared for an emergency?

That is the burning question!

Financial advisors say you need at least 6 months worth of living expenses to be even remotely prepared for a loss of income.

That’s largely because it could take you 1 month to find a job for every $10,000 in salary that you want to earn.

Meaning, that for a $60,000 salary, you could potentially be out of work for 6 months, or more!

Plus, always keep in mind, that employers hire at their convenience…not yours!

So, you could literally go bankrupt while waiting for that call.

One example happened during early 2018. A large retailer suddenly shut down dozens of stores — without warning employees!

Now, they did provide a small severance package. But, one of the former workers admitted that without income coming in, money disappears quickly!

And of course, he had no savings! But what’s worse is that he was still trying to find another job one year later!

So here’s the point, it’s better to work on ways to stash some cash now, before the — you know what — hits the fan!

6 Ways To Build Your Emergency Fund – Questions and Answers!

“The person who doesn’t know where his next dollar is coming from — usually doesn’t know where his last dollar went.”

~Unknown

1. How Do I Start An Emergency Fund With No Money?

It’s simple…start small!

Everyone has their money weaknesses!

It could be the daily $2 trip to the vending machine, $5 cup of coffee, or $7 lunch with co-workers.

And within a week, you’ll have spent anywhere from $10-$35 on non-essential items.

So the trick is to skip your daily treat, at least 1 day a week.

I know, missing one $7 lunch doesn’t sound like much money for savings.

But, at the end of the month, you’ll have added an extra $35 to your savings…just like that!

And truthfully, you’ll feel so good about having saved some money, that you won’t even miss that 1 treat per week.

Then, from there you can challenge yourself to skip 2 treats a week, for even greater savings.

And that’s how you develop discipline and begin building your emergency fund!

2. Where do you keep an Emergency Fund?

So once you’re on the road to saving, experts recommend putting your money into a High Yield Savings account.

These accounts pay above-average annual percentage yields. And that means you’ll reach your financial goals faster.

Also, many of them don’t require any minimum balances or have monthly fees.

But the most important thing is that you can access the money quickly during an emergency.

It’s a good idea to search around for the best rates.

And you can try researching local banks in your area. Or you can check out this list for more information about online options.

3. How Long Should It Take To Build An Emergency Fund?

The length of time is entirely up to you!

Quite frankly, it depends on your financial goals, and your determination to make it happen!

The most important thing is — start saving! And, be consistent!

One of the best solutions is to have the money Automatically Deducted from your paycheck.

And then — don’t touch it!

Believe me, I’ve been there!

All you need to do is just set-it-and-forget-it if you’re serious about building your emergency fund.

4. How Much Should I Have Saved In An Emergency Fund?

Well, you can start by saving enough for 1 month worth of expenses.

As I said earlier, financial advisors always give the usual spiel about saving enough for at least a 6 months.

Which is excellent advice!

But, when you’re living paycheck to paycheck, and barely making ends meet, that’s like asking you to save a million dollars!

I mean, 6 months of expenses is a daunting number!

Look at this example when I put my monthly expenses into an emergency fund calculator:

This is what it says I need for 6 months. And that’s with a paid off mortgage and no car notes! Sheesh!

Unfortunately, for most people, the number would be even larger.

So, a better plan is to start by saving enough for at least 1 month!

Think about it. Do you even know how much it costs for you to live for 1 month? As it turns out, most people don’t know that number!

And, there’s a good chance that your expenses for 1 month, already exceed $1,000, which is the bare minimum for an emergency fund.

So, the very first thing you should do is grab a pen and paper. Next, calculate exactly how much it costs for you to live for 1 month?

Then, just focus on saving that amount first! That’s it!

From there, you can slowly start to build towards saving for 2 months, 3 months, and so on.

Because it’s much easier to focus on an obtainable goal. Instead of stressing over a seemingly impossible one.

5. How Can I Increase My Emergency Fund?

A great way to increase your emergency fund is by increasing your income.

And there are 3 ways of going about it.

First off, you could try asking your boss for a raise or working extra shifts.

The second choice is to try applying for a job that pays more money.

Or, the third option is to start your own side hustle.

Personally, I’m a big fan of side hustles, because of the excellent flexibility.

You can even do a side hustle and keep your regular job.

On top of that, there are so many possibilities to choose from.

For example, driving for Uber, being a gigwalker, or turning your own hobby into cash.

Also, you can read my post of 12 great paying side hustle to earn money fast for even more options.

And keep in mind that you don’t have to work extra forever.

The main point is to work long enough to build your emergency fund and grow your savings!

6. What Other Options Are Available?

Does your company offer financial wellness programs?

If so, you should definitely be taking advantage of this valuable resource.

As it turns out, more and more companies are setting up emergency savings programs for their employees.

And do you know why?

Because they worry that too many employees are dipping into their retirement savings for emergencies.

In fact, 83% of companies feel some sort of responsibility for the financial wellness of their employees.

And, 90% of large companies are working to include financial wellness programs as part of their standard benefits package.

Amazingly, SunTrust Bank even offers $1,000 towards their employees emergency funds!

But, it gets better, they also allow for an extra day off work to organize your finances. Wow!

The bottom line is, companies know that using your 401K today seriously jeopardizes your retirement for the future.

And no one wants that!

The TakeAway

It all boils down to this, a loss of income can occur at any time!

And trying to scramble to find money during an emergency is a financial nightmare!

But, even with a tight budget, there are some steps you can take now to start building your emergency fund.

For example, starting small, saving at least 1 month of expenses, and earning extra cash.

The bottom line is, don’t waste another minute!

Because…

We can’t always predict the future,

~ Anonymous

but we certainly can plan for it!

So, what’s your plan?

NEXT ACTION:

1 Have you started your emergency fund yet? If so, how did you do it? If not, what steps will you take immediately to start? Let me know, I’d love to hear your thoughts!

2. Also, don’t forget to subscribe for even more helpful tips and strategies.

This is a great reminder that too many people overlook.

Thank you for all the suggestions too!

Your welcome and thank you for reading!

This is such an important blog post! I started saving for my emergency fund a few years back after I quit my job and found it difficult to find another job. It was such a big lesson in the importance of planning for the future! It is a stress I would not want to be under again!

Thanks, Renate,

And I totally understand being stressed out over finances! That is why I try hard to never find myself in that situation! But it does take consistent effort to stay on track!

This is such a great post with amazing tips! This is something my husband and I have been working on lately and it is definitely a process!

Yes, it is absolutely a process! And not always an easy one. But definitely a necessary one! Thanks, Karen.

This is super helpful. I racked up all kinds of debt from college and now I work for the state. It is a struggle just to pay bills. I am working so hard to pay off debt that I often forget that I need a bit of savings.

Exactly, Khadijah!

I fell into the same trap of college debt and struggling to pay bills. The good news is that you’re working on getting out of debt now. And even if you can only save $10 week, it still adds up. I had to learn to force myself to pay me first.

Like most people out there, I struggle with finances but you`re really given brilliant tips that can help anyone.Really appreciate you sharing.

Thank you so much!

I’ve been there and I know the struggles.

This is very informative, it’s so sad what happened to all those federal workers during the shut down. My cousin was affected by it, and she went through it. I will for sure share this with her!

Hi Paula,

Yes, that government shutdown was devastating for so many people.

But it really underscores just how important having a cash cushion can be.

Many people feel like it’s hard to save money, and I get it!

But, just look at how much harder things are if you don’t have at least something set aside.

I like that you suggested looking at it from the perspective of what you save at the end of the month instead of just the $7 in one a week. Great tips here for building an emergency fund!

Thanks, I hope that looking at how just giving up 1 extra expense per week can be a start to building an emergency fund.

Very well said. It makes so much difference to have an emergency fund. I can sleep better at night 😊

Yes, it definitely takes a load off your mind when you know that you have a cash cushion available.

I find it scary that people can live with zero savings to fall back on.

I agree! But I’ve also been there!

So, now I want to let people know just how crucial it is.

And even if you start by saving a few dollars a week, that’s still something!

Very informative post! I especially loved the calculators!

Thank you so much for reading!

So much great advice here. I really need to be adding more to my fund. Thank you!

Thanks Anna! And having an emergency fund is a very important safety net when unexpected expenses happen…as they often do!

This is awesome advice and a great read! Emergency savings are so important!

YES!! Emergency funds can be a life-saver when (not if) a crisis occurs! Thanks for reading!