“Always plan ahead.

It wasn’t raining when Noah built the ark.”

~Richard Cushing

Don’t let this happen to you!

True story: Sadly, a young father died in a very tragic and unexpected way.

It was fortunate that he did have life insurance.

But, unfortunately, it wasn’t enough to cover all of his burial expenses.

So, of course, his family members all chipped in to try and make up the difference.

However, when his father was also asked to contribute, do you know what his response was?

He said, “Sorry, I’m broke! I just paid my car note!”

Wow!

Of course, we all have bills! And money problems are nothing new.

But, can you imagine having to deal with the death of a child, and not even being able to help out financially to bury them?

Somehow, that just seems wrong!

But the good news is that there are solutions to some of the worst money problems that you may ever face.

Even the ones that make us uncomfortable, or that we pray never happens.

The secret is…planning!

So I’m going to guide you through some potentially life-altering events, like the story earlier.

And, I’ll give you the solutions you need, so that you’ll be well prepared before a financial disaster strikes.

Because…

Table of Contents

9 Potential Money Problems That Could Ruin Your Finances

1. Job Loss or Loss of Income

Like it or not, this could happen to anyone!

Your degree, education, or profession does not make you immune to a loss of income, or to the money problems that can occur as a result.

For instance, you might think that jobs for doctors and nurses would be reasonably safe, right?

After all, often there are too many patients and not enough staff to treat them.

But, don’t be fooled! They can be out of a job just a fast as anyone else.

Case in point, I remember a news report where the hospital staff arrived for work one morning, as usual.

And guess what happened?

They found that the facility had suddenly closed down, without warning!

And just like that — they were all immediately unemployed!

So now what?

Would you know what to do next?

Not everyone has the support of parents, relatives, or friends to help them over the hump.

And bills pile up quickly when you have no income!

Your first instinct is to begin an immediate search for a new job, right?

But, as I’ve said many times, employers hire at their convenience, not yours!

So you could find yourself out of work for months!

Solution:

Here’s the #1 best way to prepare yourself and protect your family during a sudden job loss:

Have your emergency fund ready!

I’m sure you’ve heard it a thousand times!

But, that’s because it’s essential for surviving a financial crisis!

How much should you have?

Well, at least 3-6 months is recommended.

But, even having at least 1 month worth of expenses buys you a little time to regroup.

And my post on How To Boost Your Emergency Fund With Little Money can help get you started today!

2. Underemployment

The money problems caused by underemployment is a huge concern.

Especially for people who live in areas where the cost of living is high, and the salaries are low.

For example, Barbara, a millennial who lives in a Tulsa, Oklahoma got her first full-time job paying about $27,000 a year.

But the average cost of living in her area is roughly $19,000 a year.

So based on the state she lives in, and her single marital status, her take-home pay would be around $22,500 a year.

As you can see, her take home pay barely exceeds the cost of housing and basic necessities.

And that means, there’s no room for error in her budget!

Solution:

So how can you escape the pitfalls of underemployment?

Well, you have 2 options!

First, you may need to seriously consider moving to a different city.

I know what you’re thinking!

“I don’t want to move to a new city!” Or, “I grew up here, and all of my family and friends are here!”

Hey, believe me, I get it!

Change is hard! And the unknown is terrifying!

So, I guess you’ll just have to weigh your options on this one.

For instance, in Barbara’s situation, she doesn’t even have to leave the state for better opportunities.

She could consider moving to Oklahoma city where the average income is about $3,000 more.

And the cost of living is about 8% cheaper than in Tulsa.

In fact, here’s a list of the top cities with great paying jobs and a lower cost of living.

On the other hand, if moving is definitely out of the question, then you’ll have to go with option 2.

And that is, you must find ways to either increase your income or decrease your lifestyle expectations.

As for increasing your income, you could try finding an easy and flexible side hustle.

For starters, you can read my post on the 12 Great Paying Ways To Earn Money Fast.

But the bottom line is, that struggling with underemployment can make it difficult to get ahead financially!

3. Accident or Illness

Have you thought about what you would do if you had a serious accident or illness?

And, what money problems you would face if you suddenly couldn’t work?

More than likely, it would mean that on top of your usual living expenses, you also now have medical bills to worry about.

That’s like basically adding insult to injury.

Just think about it.

You’ll have doctor’s visits, hospital costs, tests, medications, and possibly even therapy treatments.

Yikes! Of course, everyone hopes it will never happen to them.

But in reality, a medical situation can happen to anyone at any time!

For example, my husband suddenly started having severe abdominal pains.

He took some over the counter remedies and tried to muscle through it at home. BUT, it only got worse!

So to make a long story short, he ended up having emergency surgery.

Then he was hospitalized for several days, and unable to work for 2 months!

Now, this could present real money problems for anyone that is not prepared.

And as it turns out, medical bills (not consumer debt) are the #1 reason people file for bankruptcy each year.

Solution:

So how can you get financially prepared for an unsuspecting accident or illness?

Well, you should probably consider getting long or short-term disability insurance.

I know what you’re going to say!

That sounds like taking on another bill!

Not to mention, what if you never need it!

Both points are valid.

BUT, what if you do need it?

The bottom line is that it certainly could come in handy. Especially if you ever find yourself facing an unexpected medical situation.

And, if you’re forced to take medical time off like my husband was.

Plus, disability insurance can pay up to 80% of your salary when you can’t work due to a personal accident or injury.

In any case, it never hurts to shop around for rates and see if it’s feasible to work into your budget.

Because the last thing you need to worry about during an illness is how are your bills going to get paid.

4. Moving Out On Your Own

As if they think the parent is supposed to be crushed by that or something!

For example, when my nephew was 15 years old, he told his mom that — he can’t wait to turn 18 so he can move out.

Then, when he was 16, he still said, — he can’t wait to turn 18 so he could move out.

And when he was 17, he still insisted that he can’t wait to turn 18 so he could move out.

So guess what happened?

He eventually turned 18.

I think his mom may have even danced a little jig!

Then, she reminded him, “now what is that you said you were going to do when you turned 18?”

Do you know what he said?

“Go to my room!” LOL!

Well, the truth is, growing up happens way too fast! As I’m sure, any grown-up can attest to!

And most young adults are in for a rude awakening when they’re faced with the challenges of having to fend for themselves in the “real world.”

Just think about it for a moment.

Here’s just a snippet of what to expect:

- Paying rent every month.

- Going to work every day.

- Buying food every week.

- Paying for Water, Electricity, Heat, Internet.

- Transportation costs.

- Insurance, and more.

Yeah, that all sounds like fun alright!

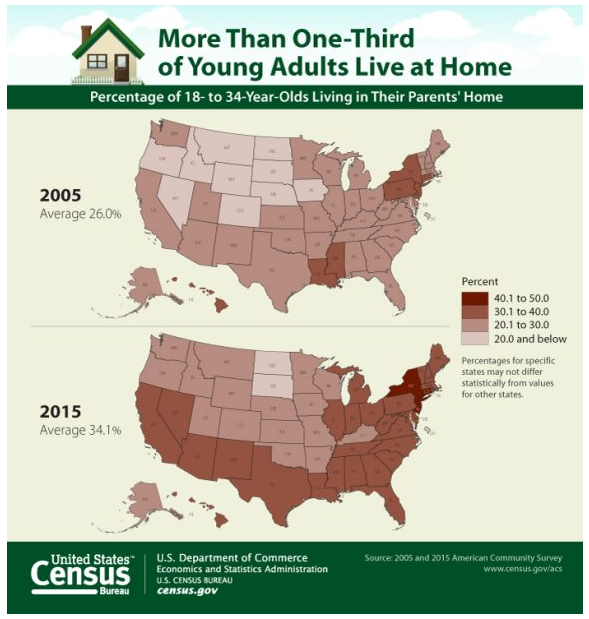

Apparently, that’s why more than 30% of young adults scurry back home to mom and dad pleading, ”let me in, let me in!” (haha).

Because they quickly find out — that the Reality — is nothing like the Fantasy they had built up in their minds.

Solution:

So, what should young adults do to totally Crush It when moving out on their own?

Here’s a list of must-do actions:

1.Save! Save! Save!

Trust me, you can’t ever have too much money saved before moving out!

And to avoid money problems later, you should definitely do a little research beforehand on the area you’re interested in.

Start by checking out the average rent, salaries, utilities, and transportation costs.

Then, begin saving at least 6-8 months of expenses or more, before you move out!

That is if your parents will even allow you to stay that long.

2. Begin establishing credit

One way to do that is with your savings account. Because how well you manage your savings account shows that you are responsible.

You can also apply for a credit card with your bank for a starter amount of about $500.

Warning! Credit cards can be addictive! So use it sparingly! And, never charge more than you can comfortably pay off in one month!

Remember, you’re only trying to establish a healthy credit history — not to create debt!

3. Prepare to downgrade your lifestyle

Of course, no one likes to hear that!

But, chances are that you won’t start your career at the top!

Your parents worked years to get you to the lifestyle you were accustomed to.

And likewise, it may take you a few years to get yourself back to that same level of comfort, or better(smile).

The most important thing is to do as much as you can to decrease your risk of needing to run back home crying to mom and dad.

5. Raising A Child

Kids are such cute, amazing, intelligent little beings! And we love them to pieces!

With that being said, I recently came across this comment…

“If people knew the truth about raising kids and being married, there would be a lot less married folks, and even less kids!”

~An anonymous, married, working mom

Okay, so that remark may be a bit over the top!

BUT, the plain and simple truth is that having children does cost a lot of money!

There’s no need to sugar coat it or dance around the issue…it is what it is!

And the fact is, that it starts at birth!

On average, the cost of having a baby in the US is about $11,000 without complications.

And it only goes up from there!

Because, when you add the cost of housing, feeding, clothing, and healthcare for the next 18 years, you’re easily out of $200,000 — per child!

Oh, and that number doesn’t even include the cost of college by the way!

Solution:

Before you even begin having kids, you’d be wise to do the following things:

- Have a steady job.

- Create a family budget, and stick to it! Developing this skill now will help you maintain financial discipline after having kids.

- Build Your Emergency Fund. Personally, I recommend a minimum of 1 month worth of expenses for emergency situations only.

- Set aside at least 6 months worth of savings. Of course, 1 year is preferable. And although it may be harder to accomplish, it’s not impossible. Regardless, just do your best! Also, keep in mind that this is separate from your emergency fund.

- Plan for childcare costs. Will both parents work? Can you afford to live on 1 income? Or, will you need childcare? Decide ahead of time! And you can even create a savings account specifically for childcare costs. But, this should also be separate from your emergency fund and your main savings.

- Pay off Credit Card Debt! The less debt you have, the better off your finances will be!

- Knock out as much student loan debt as possible! Maybe even consider refinancing or consolidating loans. You can check out some possible options here.

- Create a “new baby” fund. This will help with any immediate baby care needs and items that you may not have received as gifts.

- Start a college fund. And “no” it is not too early! Because tuition costs seem to skyrocket every year!

Well, that’s just a small sample to at least get you thinking and planning before raising a child!

6. Divorce Costs

So I’m sure you already realized that the quote from the last section applies here as well!

Of course, when you begin a marriage, no one wants to think about it ending in divorce.

But sadly, life is not a fairy tale! And every marriage doesn’t always get a happy ending!

For example, Tori was a stay at home mom with a young daughter when her marriage ended after 10 years.

Suddenly, she found herself with no job, no insurance, raising a small child, and facing a mountain of debt.

Eventually, she had no choice but to sell the home she received in the divorce, and move back in with her parents.

It’s unfortunate but, after a divorce, women, and children are the ones who suffer from money problems the most.

Particularly, if the man was the primary breadwinner!

Solution:

So, here are some things you can do:

- Meet with a financial advisor. Start with your employer or credit union because they may offer free financial counseling services.

- Assess your assets. Make a note of all investments, savings, equity, and cash on hand.

- Start saving as much as you can. This will help you offset some of the legal fees and other expenses you may encounter.

- Make copies of all documents. This includes mortgage, car titles, and life insurance policies.

- Review and revise your beneficiary information if needed.

- Make an agreement to work together. The more amicable the divorce, the less costly it will be for both sides.

- Research to see if you qualify for legal aid services.

- Check the American Bar Association website for Pro Bono services or any low-cost legal services programs.

- Find out if your local county courts offer a Family law facilitator, which is a free service.

- Consider a Divorce paralegal. They’re an affordable alternative to lawyers when you can’t find free services in your area.

Also, I came across this great website LawHelp.org that I can’t pass up mentioning.

You can select your specific state to find information on free legal help.

It also provides answers to FAQs and even a checklist with instructions and forms.

7. Death

Okay, so here’s a sensitive subject that no one likes talking about.

Yes, it’s unpleasant. And, it makes people uneasy.

But, be that as it may, it’s also an inescapable fact of life!

And Heaven forbid that your parent, partner, or child should die unexpectedly.

Then, just like the dad from earlier, you could find yourself without the funds necessary to bury your loved one.

Or even worse, what if they didn’t have their money affairs in order?

Now you’re stuck with the nightmare of handling their remaining debts.

Because we all know that — tomorrow is promised to no one!

So, it’s crucial to make the difficult decisions today, while there’s still time!

Solution:

Now here are a few tolerable steps you can take to prepare for the unthinkable:

- Designate your medical and financial power of attorneys. These are legal documents. And they name the people who you have chosen to make medical and financial decisions on your behalf. To learn more information click here.

- Create a Will. This allows you to name guardians for your children, if necessary. And, you can keep down the confusion over who inherits what when you’re gone. You can click here to learn the steps to creating a will.

- Purchase Life Insurance. Funerals are not cheap! And no one wants to leave the burden of their debts or funeral costs on their loved ones. So, check out this site to compare rates.

- Keep your documents in a safe place. And make sure your family knows where to find them!

So the bottom line is that death is hard enough!

But you can lessen the financial impact on your family if you start planning now.

8. Retirement

Can you afford to retire?

As it turns out, many people can’t!

Take David for example. He’s in his late sixties. He has some health issues.

He still works full-time. And, he complains frequently that he’s too old to continue.

But, whenever he’s asked why doesn’t he just retire.

His response is always that he can’t afford to retire.

Now, just imagine working your entire life.

Then reaching retirement age and never having enough money to actually retire. Aye Yai Yai!

On top of that, the fluctuations and uncertainty of Medicare and Social Security have the outlook for many retirees looking quite bleak!

In fact, it’s been reported that millions of Americans have $0 saved.

And that 42% of them will retire broke.

So what can you do?

Solution:

Let’s take a look at some ways that you can ensure better security for your retirement:

- DON’T-TAKE-ON-NEW-DEBT! This should be obvious, but it bears repeating. Because debt is a huge obstacle that can block your retirement!

- Pay off current debt as quickly as possible.

- Maximize your 401K benefits with your employer.

- Speak with a financial advisor. It may be a free service through your employer or credit union.

- Live a frugal but comfortable lifestyle. Don’t worry about what other people have. Focus on your future and spend responsibly!

- Look into additional health insurance options. You can even speak with your Human Resources department about retirement insurance benefits. Or check out the website healthcare.gov to compare rates.

- Use a retirement calculator. It gives you a realistic picture of how much money you will need to retire comfortably.

- Begin saving NOW, as much as you can, while you still can!

Finally, we’ve come to the last of our major money problems — and it’s a doozy!

Why? Because it’s insidious.

And it plagues people throughout their lives.

So what is this pesky money problem that everyone needs to avoid?

It’s goes by name of…

9. Consumerism

You’re probably wondering — what the heck is consumerism?

Well, let me ask you this question.

Do you ever feel compelled to buy stuff?

For instance, the latest iPhone, PlayStation, 4K TV, designer clothes, shoes, handbag, or Apple watch?

If the answer is yes, then you are a victim of consumerism my friend.

It’s all about being preoccupied with buying and keeping up with the next big consumer trend.

There was even a time when I fell prey to lure of consumerism.

Truthfully, buying stuff can be hard to resist.

Especially when you’re bombarded daily by Ads and marketing tricks.

And you may feel pretty good about it at that moment.

But, the after-effects can leave you with a busted budget and an empty bank account.

Think I’m joking?

Just read my posts below and see how badly your money and your mind can be affected by consumerism:

How To Overcome The Gut-Wrenching Pleas Of A Neglected Savings Account.

3 Money Sabotaging Chains That Hold Your Finances Hostage.

Oh, and did I mention that consumerism is also the fastest way to accumulate consumer debt!

Solution:

So here are some easy tips you can try to help combat consumerism:

- Leave the credit cards at home! Money problems don’t create themselves! Enough said!

- Only carry as much cash as you need, for the expense that you have budgeted for.

- Don’t get tricked into overspending. Not by salespeople, not by advertisements, and certainly not by frivolous friends.

- Stick to your budget! Remember, you have one for a reason.

And my post on the 5 Reasons Why I Still Respect The “B” Word And So Should You will help remind you of that reason!

The Takeaway

So as you can see, money problems can occur at so many different stages of life.

But, every one of these issues that you may face can be easily managed with good planning.

Or, they can be made worse by inaction.

And of course, no one wants to let their family down when they need you the most.

Even if your financial situation is not favorable right now due to lack of planning — there is still time!

You can use all the great information you learned above to put a good action plan in place going forward.

So, which money problems will you tackle first?

NEXT ACTION:

1. If you need easy to understand instructions for starting a blog, then check out my post on How To Start A Blog The Right Way In 7 Easy Steps.

Great post! That was a really sad story about not being able to contribute to a family member’s funeral. Anyway, I like that you provided solutions for every problem.

Thank you so much for reading. And I always try to provide as much helpful information as possible.

Great tips! I’m the breadwinner of our family so IIexperience most of these problems at a very young age. Though it was a gard experience for me, I was thankful because I learned how to save and grow my money.

I’m currently tackling #4 (investiig onoa house right hopnow)and efully after that put more money on #8 (retirement)

Your blog post reminded me of the past and made me feel grateful of what I am today. Thanks you.

You are very welcome!

And keep up the good work with saving!

A well rounded post DeShena. Love the clean look of your Blog.

Thanks so much for reading. And I personally don’t like distractions on my blog that take away from the reading experience.

Very in-depth article! I feel like werew using the same WP theme. I also published something similar on my blog last year. Good job!

Thanks Mary,

It’s not surprising that you’ve published something similar because these are important issues that everyone should be aware of. And, I guess great minds think alike! 🙂

Such a fantastic source of information! I’m 24 & I find it all extremely overwhelming ahah! There’s just so much to think about!

-Madi xo | http://www.everydaywithmadirae.com

Oh yes, I’ve been there! And life can throw you so many curveballs. That’s why I wanted to give people a heads up on some of the important potential money situations that could arise. But, don’t stress! And take baby steps if you must. But you have increased awareness, so just start preparing as soon as you can.

Thanks so much for this great & practical financial advice!

You’re very welcome and thanks for reading!

You brought up some big issues. It is really important for people to be informed and make preparations to be smarter with their money.

Absolutely!

Thanks for reading!

These are great issues you brought up, specifically the one about retirement. Most young people are still paying on their student loans and cannot afford to save for retirement or move out. That’s where your tip of cutting costs really comes in handy! I think if more people learned to live without things they don’t need, they would be happier with their financial lives.

Thanks for sharing!

You’re welcome Skyler, and you’re also correct!

When you’re young you are very idealistic.

So that’s why it’s important to not only listen but to also learn from those who have been there.

It can save you so much headache in the long run! And as you get older you realize, those material things — become more and more immaterial!

Thanks for these awesome tips. I’m the breadwinner right now and I’ve been discussing how to best be prepared for anything with a financial adviser. I think it’s best to be prepared for anything because you never know what’s going to happen.

You are absolutely right! And great move talking with a financial advisor!

This was a really good read and actually gave me some ideas about spending and budgeting. Thank you for this. I’ll make sure to use a few of the tips you have in your post.

Great Mariam!

I really hope they help!

This is such an in-depth article. so much amazing information. A lack of financial planning could certainly put someone in a very bad situation!

Absolutely!

And often we don’t think about things until it’s too late.

So, I hope I can help put people on the path to not only thinking about these events but to start making some real plans!

Even if they have to take small steps at a time.

Whew! This blog puts life in perspective. I am currently working on getting to the 6months of savings point. I just had my first child and I need to get serious about being prepared financially. I have to pin this for later!

LOL, Shannon! Yes, it is a lot. But, I try to be helpful and at least go a little deeper to get people really thinking. Thanks, for pinning! And do come back!

These are amazing ideas for watching and planning for expenditures and I love how you incorporated all aspects and ages of life. Thank you for this great article!

Thank you so much for your comment, Sasha! And thanks for reading!

This is a good overview of areas to be on the lookout for financial problems. I especially appreciate that you mentioned burial of a loved one. My parents recently passed away and other family members didn’t have any money to help bury them or deal with the upfront expenses of their estate. We will get reimbursed for our expenses, but if we hadn’t had the money upfront to manage this, I don’t know what would have happened.

So sorry for the loss of your parents Kimberly!

Yes, burial costs are never fun to talk about! But unfortunately, it is a fact of life!

And, I definitely understand just how important it is to bring awareness. And, to hopefully help someone so they can at least start thinking about things they should be preparing for ahead of time.

A word to the wise is sufficient. We are all about planning ahead too, and fixing what we can before it’s too late.

Smart move to plan ahead!

Thank you for sharing this

Please visit my blog when you have a chance!

Hi Natalie, I visited your site and also left a comment.

Thank you for this! These are important things to think about as I only have one year left before I become an adult!

You’re welcome! It’s great for you to know the importance of being prepared as early as possible. Even if you only take small steps at a time it will help you in the event unexpected things occur. Thanks for reading!

You’ve covered so many significant life events that require financial preparation! This is so thorough, DeShena! Great blog post!

Thank you so much, Keesha! And thanks for reading!

Thankfully, we have had life insurance for the last 15 years, but recently—after the deaths of our parents—we also purchased a prepaid funeral benefits package as well. We try to be mindful that we live our best lives, but also prepare for some of those unexpected eventualities as well.

It always smart to do as the saying goes…hope for the best but prepare for the worst! Thanks for sharing!

Great post! Very helpful tips and inspirational to get out of debt and be prepared for anything that life throws at us!

Exactly! Thanks for reading!

This is really valuable information. I wish I had been better prepared. My husband and I took our kids out sledding a couple years ago and that day changed our lives forever. What started out as a fun family outing ended with my husband breaking his back. He had spent his entire career working in structural steel and that came to an end that day. No one ever expects those types of things to happen, but they do. Thank you for spreading awareness and sharing information to help people be prepared for anything.

Oh My Goodness, Melissa! So sorry to hear about your husband’s accident!

Situations like that are exactly the reason why I felt this post is so important. I think somewhere in the subconscious people know that things CAN happen but they REALLY think it will happen to them. My goal was definitely to put it out there so that I could raise awareness.

Thank you so much for sharing your story and God Bless you and your family!

The emergency fund is so important, and so many people don’t have one. Also, it’s easy to skimp on a 401K when you have current bills due – but I’m looking forward to being able to retire. So I’m just going to have to live without the pretty object that caught my eye in the store. Still, rather do without now, than later.

That is the attitude we all need…to live without the pretty objects trying to steal our money now so we can have a better future later! Thanks for sharing!

Wow! This post is packed full of so much information! I’ll be reading this one again!

Thank you so much! And I’m glad you found it useful. Please do come back!

Wow, I really loved how thoroughly you went through each scenario and you are totally on point! Each of these can happen to just about anyone. And each of your solutions are doable! One thing that prevents my husband and I from spending our savings is turning it into silver bullion. It looks prettier, feels better, and needs to be turned back in to a dealer to be negotiated back into paper money when we need it, so therefore we’re less likely to go through that process unless we absolutely need it! We invest in a fair amount every tax season and it just keeps on building 🙂

Excellent idea Brooke! That is a great way to hide money from yourself and grow your savings! And you’re right…silver bullion are certainly prettier than paper money!