Budget! Budget! Budget! Do you ever get sick of hearing the “B” word?

I know I sure did.

It’s always ~ budget for this and budget for that. Enough already! I was tired of hearing about a freakin’ budget.

The truth is, I’ve tried to create budgets in the past. And do you know what happened? They left me thinking the same thing that lots of people think, that:

-

- Budgets Suck!

-

- They don’t work!

- AND, they’re too time-consuming!

At one point, whenever I heard the word budget, I would immediately dismiss it and start looking for something else.

The problem is, that I would frequently find myself short on cash, late paying bills, and with no clue how to fix it.

So I was always searching for the Next Big Thing to improve my finances. But, it all kept leading me right back to the same conclusion…I needed a budget! Ironic isn’t it?

Eventually, I stopped endlessly searching and started seriously working on my budget. And I found out that — budgets have gotten a bad rap.

Because within a few months time, I went from living paycheck to paycheck, to:

- Creating an Emergency Fund.

- Paying my bills on time.

- Feeling more in control of my money.

- And even improving my credit score.

Now, what’s not to love about that?

I finally had to face the fact that a budget is a good thing. And here are the 5 money issues my budget helped me resolve. So if you struggle with any of these things — then you need a budget too, my friend.

Table of Contents

1. I Was Lousy At Managing Money!

This is a darn shame! But until I began budgeting, I had no idea where my money was going every month!

I remember one day at the grocery store when my bank card was declined at the register. And I’m standing there speechless, with my mouth open thinking, “Where did all my money go?”

I thought for sure I had enough in my account to cover my groceries. And I could feel the heat from the Beet RED glow of shame on my face as I fled the store! I immediately went online to check my banking transaction history.

Turns out that a transaction paid that I had forgotten about. Sound familiar? Well, it ended up draining nearly $80 from my bank account.

And do you know why that happened? Because I didn’t have a BUDGET to track my expenses!

Needless to say, avoiding embarrassing moments like that is the main reason why me and my budget are now BFFs.

And if you’re sick of hearing that word (like I was), then call it a spending plan. Because that’s all a budget is anyway.

It gives you more control over EXACTLY where your money is going!

“Now how is this a bad plan?”

~ Jacopo, The Count of Monte Cristo

The good news is, that if you need help getting started you can try a highly popular site like Mint.

-

- It’s free to use.

-

- It tracks your spending.

-

- And you can even check your credit score.

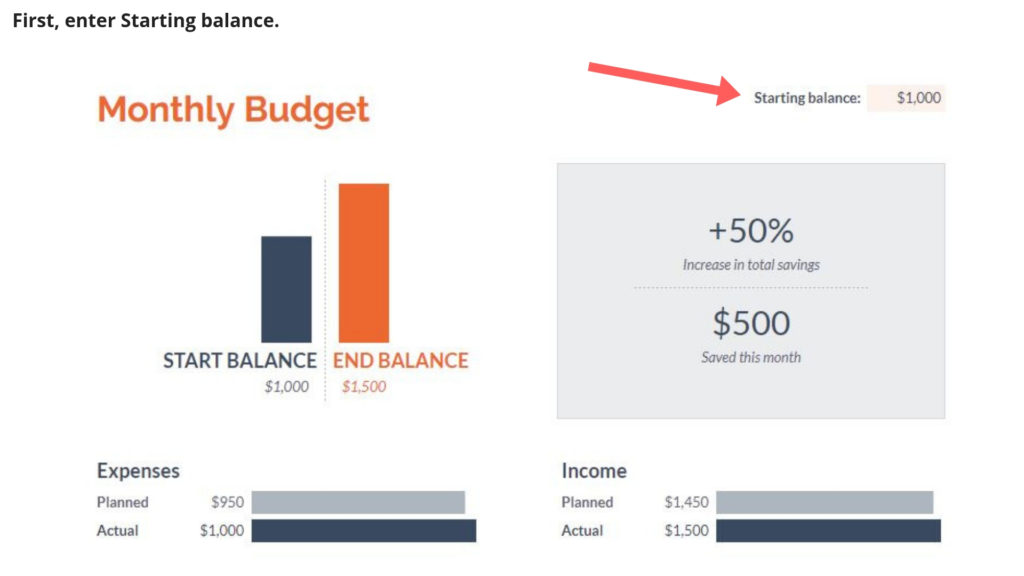

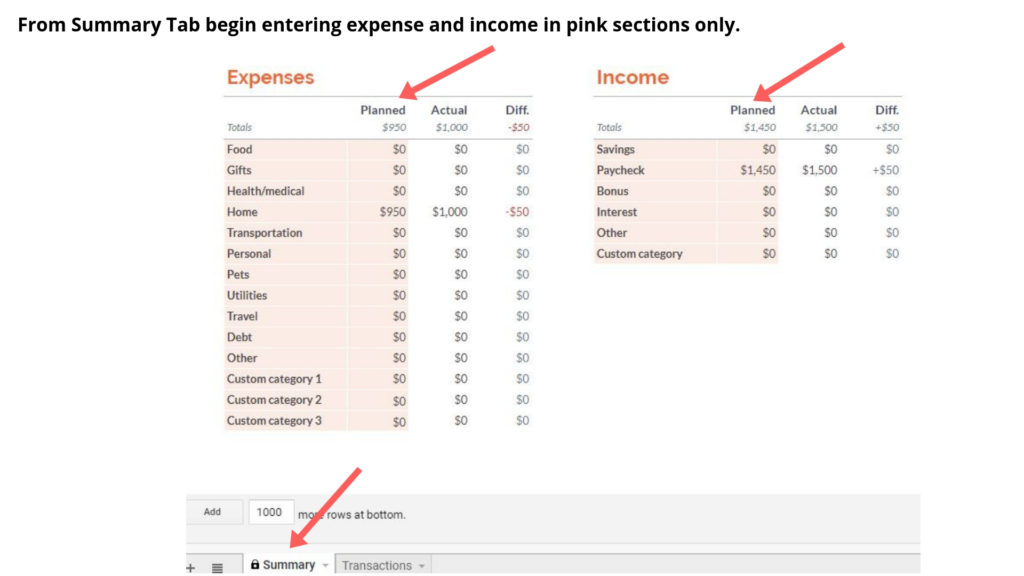

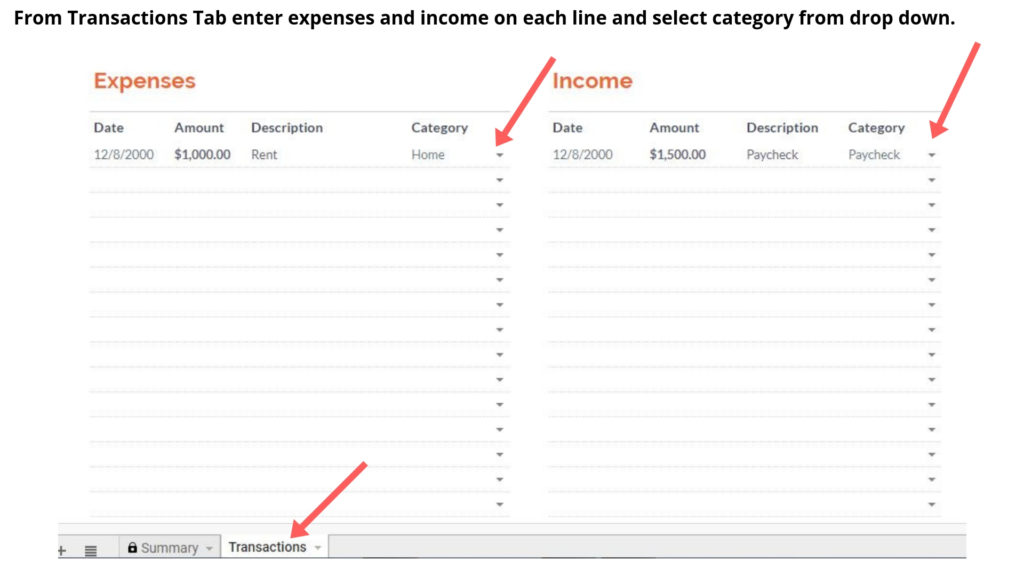

But if you just want a quick and simple budget template, then Google Sheets has one that’s perfect.

Example:

First, go to Google Sheets. You can log in to google or download the app if using a mobile device.

Next, click the Monthly Budget tab and this screen will appear. Then follow these steps:

From there, the document does all the calculations for you. It’s that simple.

So whether you choose a website like Mint or a budget template like Google sheet, both options are easy to use. And they each provide visible evidence of what’s coming in. And more importantly, what’s going out.

2. I Didn’t Know How Much Money I Was Wasting!

Okay, now I need to admit something. I used to be too lazy to budget!

I preferred to keep track of my spending in my head. Bad idea! Every time I did that, my negative bank balance would scream at me to Stop – Doing – That!

So I had no choice but to start writing everything down. And guess what? It helped! Of course, it’s not the one-and-done quick fix I would have liked.

But, I do actually manage my money better when I write down my spending plan for every dollar…huh, go figure!

Mainly, because having it all in front of me, in black and white — helped me to zero in on the areas where I wasted the most money.

It makes you reconsider if you really want to spend well over $200 a month on Cable TV. Or $150 on an overpriced cell phone plan.

Before I knew it, I was making drastic cuts in my spending. And, I could more easily identify opportunities to increase my savings.

So when you think about it that way, how could anyone NOT want a budget?

UNLESS of course…they don’t really want to know the truth about their spending! And if that’s the case, then they can just keep doing whatever they’re doing now.

And as Dr. Phil would say:

“How’s that working for you?”

3. I Sucked At Saving Money!

This was a plain and simple, in my face FACT!

My bank account was so empty that it was practically begging me for even a smidgen of cash.

But the reality is that — it’s hard to save money without a budget.

No matter how good your intentions are at the beginning of the month, somehow the money is all long gone before the end of the month. So I created a list of Top 25 Budget Hacks that provide a quick, fool-proof reference guide to saving money…click here to download.

And here’s a sobering fact, if you’re saving less than 3% of your income — then you’re never going to build wealth. In fact, to be financially healthy experts recommend that you save at least 10-20%.

BUT it doesn’t stop there! If you ever want to actually achieve financial freedom…then you have to save even more aggressively. I’m talking 35% of your income, my friend!

Sounds like a lot, I know!

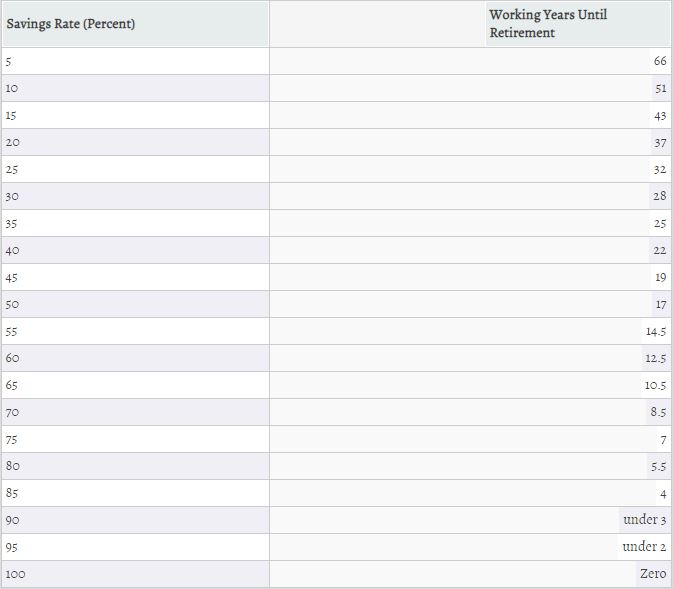

But what if I told you that only saving 5% of your income would take you 66 years to retire. WHAT! Shocking isn’t it!

Well, check out this chart that I came across on both Making of a Millionaire and Mr. Money Mustache.

Fortunately, a really smart person has done the math for you. And this clearly lays out your rate of savings against your number of years until retirement. For example: 5% saved = 66 years to retire.

So, after looking at this chart is your mind blown? Mine sure was!

The good news is that a budget gives you a chance to be proactive.

You should definitely start by setting aside some money for savings at the beginning of the month (while you still have funds), even if it’s just $20.

Then treat that amount as a bill and add it to your budget every month.

You can also open a fee-free online savings account with banks like CapitalOne360 Savings. And, you may even earn a small bit of interest on your money…Winning!

4. I Couldn’t Answer, “WHERE’S THE MONEY”!

It’s sad to admit, but so true!

But, I’m not the only one. I mean, even the American government is lousy at managing money.

The difference is, that they don’t have any real incentive to create a balanced budget. After all, they’re wasting our hard earned dollars, not their own!

However, when it’s your own money on the line, there are plenty of incentives to improve. Just think about all the things you want to achieve like:

-

- A new home.

- A new car.

- A family vacation.

- And even just having the satisfaction of being in control of your money.

Yes, a budget can do all that!

But before I started budgeting, I couldn’t make any big plans. Because it was so easy to lose track of my spending.

All it takes is a few extra lunches out with co-workers. Or buying a new pair of shoes because they were on sale. Or picking up extra groceries at the market.

Yes, I’m guilty of all those things. But I discovered that doing these things doesn’t have to be a problem. As long as you have planned for the expenses within your budget!

Now, I make a habit of working on my budget every payday. I list all my expenses for the next 2-4 weeks. And I can quickly see if there are any extra funds available or what cuts need to be made.

5. I Was Clueless About My Spending Limits!

Finally, we’ve reached the single-most important reason why myself and so many others desperately NEED a budget!

Because we need limitations!

There are many things in life don’t need limits. For example, love, creativity, and following your dreams — to name a few.

But your budget — is not one of those things. And it needs limits, my friend!

Especially, with the rapid growth and simple use of digital money. Everything is just…scan and go.

I personally have not gotten that advanced yet. I still pull out my debit card or use cash for purchases (notice I said debit, not credit).

And quite frankly, with my history, I don’t need anything that makes it easier for me to spend money!

Because nowadays, trying not to overspend is like trying not to slip when walking on ice.

A fall is definitely coming! Unless of course, you’re wearing ice skates and you know how to use them!

The good news is that we can also turn the tables and use technology to your advantage.

How?

With apps, of course!

Let budgeting apps like Mint, PocketGaurd, and YNAB (you need a budget) act as your financial ice skates…if you will.

They help keep your spending in check, so there are no hard falls in your future.

The Takeaway

Some “B” words may do more harm than good, as you can imagine.

But, a budget is your friend!

I think my main resistance initially was because it wasn’t a quick fix. It took consistency and persistence to be effective.

Once I finally became serious about my budget, I was able to start saving at least 15% of my income.

I cut out wasteful spending on things like overpriced cable and cellular plans. I thankfully now pay all my bills on time. And I improved my credit score by more than 150 points.

Wow!

So after seeing all the positive results on my finances, I have no choice but to give the “B” word the respect it deserves. And if you stick with it, so will you.

So what are your feeling about budgets? Have you ever tried one?

TAKE ACTION:

- Leave a comment below and tell me your thoughts.

- Download my Top 25 Budget Hacks Freebie.

I loved this post. You know your stuff. I will definitely refer to this when making my budget plan for 2019 #budgetgoal

Thanks for checking it out! I really hope it helps you stay on track with your budget in 2019.

I love how you really broke down actionable ways to create a budget! I even have a mint account and didn’t realize it did all of that! This is perfect timing right before a new year!

Thanks, Monica! It is so true that having a budget and sticking to it is especially important during the holidays. Otherwise, you will literally be paying for your actions well into the next year.

Inspiring and very helpful! It really does take self-discipline to manage our financial life! Hope to read more!

It is the best time to make some plans for the future and it is time to be happy. I have learn this put up and if I may just I want to counsel you some fascinating issues or advice. Maybe you could write subsequent articles regarding this article. I desire to read even more issues about it!

Thanks for that feedback. I’m glad you enjoyed the article and hopefully, I’ll be able to do more soon.