If a game show offered to give you $50,000 cash or a $50,000 Mercedes-Benz…which would you choose?

The decision should be a “no-brainer, right?”

TAKE THE CASH!

Why?

Because all you can do with a car is drive — from point A — to point B — and back to point A again.

Whereas with fifty grand, you could:

- Secure your emergency fund.

- Feed your savings account.

- Pay off your credit cards.

- Pay down your student loans.

- Set yourself up on a better financial footing.

Do you see my point?

When used responsibly, you would get so much more value out of the cash, than you ever would get out of the car!

But backing up for a moment in case you’re wondering.

Yes! There is a difference between an emergency fund and a savings account. This post by Financially Fit and Fab can give you a quick overview of that.

Now I’m sure you’ve probably heard of downsizing by now.

And how people are getting into the whole minimalist idea as a way to save themselves both stress and money.

So what do you think about it?

Have you ever considered downsizing a bit?

Or have you completely dismissed the idea because the name sounds like you’ll be missing out on all the good stuff?

Well if that’s what you’re thinking.

You couldn’t be more wrong!

It’s not about settling for less — it’s actually about expecting more!

So try this.

Instead of thinking about it as downsizing, I prefer to think about it as rightsizing.

And here’s why.

Table of Contents

Rightsizing Definition

According to various dictionaries, rightsizing is:

- To reduce in size.

- To make smaller.

- To eliminate excess.

Now look at what happens when you apply that definition to your finances.

- To reduce in size money-related stress.

- To make smaller bills.

- To eliminate excess Debt.

Hmm, suddenly rightsizing doesn’t sound so bad, right?

And here’s the best part.

I’ve discovered that it is possible to live a comfortable life — without being extravagant!

Yep! And guess what?

That is precisely how I became Debt-Free!

Plus, I don’t have to miss out on anything!

Case in point, when a fellow blogger invited me to go to FinCon 2019 and share a room — I didn’t have to think twice.

And do you know why?

Because rightsizing your life allows you the freedom to:

- Stay away from using credit cards.

- Get rid of daily stress over bills.

- Avoid ever having to borrow money.

- Be ready to seize the moment when opportunity knocks.

SO…what’s not to like about all that?

AND, in case you missed it, check out my post on How To Save Money Like A Frugal Millionaire. It shows that even a millionaire knows the value of rightsizing his life to save money.

The good news is, you can do it too!

And here’s how.

3 Ways To Save Money By Rightsizing Your Life!

1. Rightsizing Your House.

Here are some forgotten but fascinating statistics.

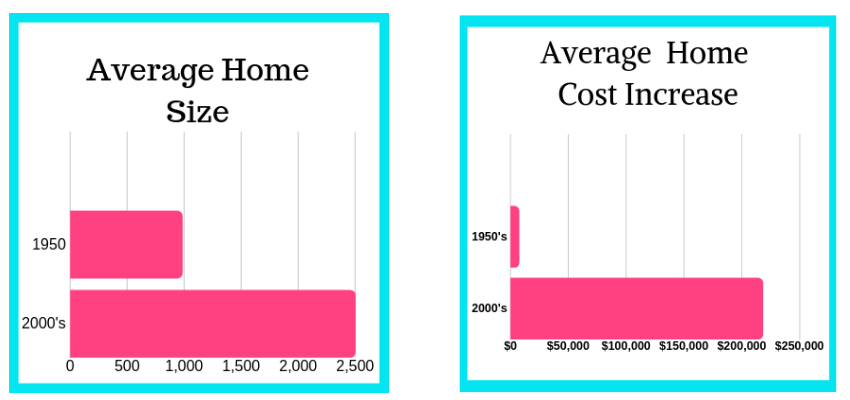

Did you know that in 1950:

- The average home size was less than 1000 square feet. And it cost approximately $7,300?

- The median household income was only $3,300?

- And the average family consisted of 3.8 people?

Fast-forward to 2018 and look at the mind-blowing difference:

- The average home size runs about 2,600 square feet, and cost approximately $218,000.

- The median annual earnings were approximately $46,600.

- And the average family size was approximately 2.5 people.

So let me get this straight.

Family size has gone down, while earnings and home prices have EXPLODED.

But that’s not the most interesting part.

Because to do you know what else has EXPLODED?

So I guess that only goes to prove — that bigger isn’t always better!

It also proves Parkinson’s Law of Expenditures, which says that…

“Expenses always rise to meet income.”

So in other words:

The more money people make, — the harder — and harder — they try to spend every last bit of it!

And one of the biggest money mistakes people often make is buying Too – Much – House!

So the best way to correct that and get your finances out of the red and into the black is:

- If purchasing your first home, then here’s my bit of sage advice. Look for one that you can afford with only one person’s income.

And “no” that’s not crazy talk!

Because remember, in the 1950’s they pretty much did everything on one income.

Yes, I know this isn’t the 1950s. And the cost of living has skyrocketed.

But, so have our salaries!

It’s our extravagant lifestyle choices that have gotten out of hand!

And the families of the 1950’s not only survived on one income — but they thrived!

- If you’re already bogged down with a high mortgage home, then consider selling.

I know you’re thinking, that is easy for me to say.

But hey, I’ve had a mortgage before as well.

That’s why I’m trying to share my experience to help get you to Debt-Freedom — like I am!

Now should you decide to sell, then you can use those funds to buy a cozy and affordable home for cash.

And wouldn’t it be nice to breathe again, without a large mortgage suffocating you every minute of every day?

I know I sure enjoy being mortgage-free! Yes, Lord!

- Never purchase a home based on your gross income.

Truthfully I never understood that logic!

It seems like a trap designed to suck people into more debt than they can handle.

Think about it.

You’ll never actually have access to your gross income. So how can you factor that money into anything!

But I know that most people can’t afford to buy a house for cash.

So in that instance, you need to aim for nothing longer than a 15-year fixed mortgage.

However, if your mortgage is longer than try to refinance for the 15 years or less, if possible.

We refinanced ours for 12 years and that was such a relief.

Especially since I have an intense fear of long term financial commitments!

Also, make sure you can put at least 20% down.

And that one person’s salary can pay all the bills.

I know that’s not the usual way Americans do things.

We all want bigger, better, more, more, more!

BUT, the usual way doesn’t work!

That’s why approximately 80% of American live in debt!

With that being said, there’s no time like the present to rethink the way we do things!

The next thing you should try is…

2. Rightsizing Your Car.

Like I said earlier, the main function of your car is to get you from point A to point B and back again.

So your primary goal, if you want to save money, should be a car that is:

- Dependable.

- Affordable.

- Fuel-efficient.

You should not focus on impressing your colleagues or neighbors, especially if it means taking on unnecessary debt.

Here’s an example.

I heard a story of a woman who was insanely desperate to drive a Mercedes-Benz.

So much so, that she ended up financing the car for ten years, just to be able to get one!

Wait…what?

I mean seriously — who does that?

So here’s what I’ve learned about rightsizing your car.

- First off, anytime you pay more than 36 months for a car…

Then you have too much car!

Think about it.

Even most car warranties don’t last longer than 36 months.

And neither should your car payments!

Just imagine a few months after your warranty expires, and then your car’s water pump breaks.

The next thing you know, you’ve got to come up with an $800 repair bill WHILE still paying a huge car payment! Ouch!

Yeah, I’ve been there! And trust me — it wasn’t fun!

- Choose a car based on value over luxury.

I’m sure you’ve realized by now that I’ve been down the living in debt while owning a luxury car road.

And all it did was lead me to more financial headaches than I can to count.

That includes the large repair bill I just mentioned.

So what can you do?

Well, one great trick for rightsizing your vehicle is to consider buying Certified pre-owned instead of new.

It could save thousands of dollars.

And someone else has already taken the hit for the car’s depreciation.

That means, more of your money will go towards the actual car than towards the financing.

- Buy a car for cash.

You’ve probably already guessed that I’m a strong advocate for paying cash for everything!

Here’s why?

Because when you use cash, you can never pay more than what you have available.

But if you don’t have that kind of cash.

Then my post on the 12 Great Paying Ways To Earn Money Fast can help.

Plus, you could also save any raises, bonuses, and tax refunds to put towards your purchase.

You could even try picking up an easy side hustle to earn extra money.

So now that we’ve discussed rightsizing your home and rightsizing your car here’s what you need to focus on next.

3. Rightsizing Your Credit Cards.

The debate over whether credit cards are necessary varies widely depending on who you ask.

Why so much uncertainty?

Because on the one hand, they can:

- Help boost your FICO score.

- Establish a credit history.

- Show how responsible you are with your financial obligations.

BUT, on the other hand, they can also:

- Negatively impact your credit score if you make late payments.

- Lower your chances of qualifying for a mortgage if you carry high balances.

- Increase your likelihood of spending money you don’t have and ending up in debt.

Regardless of which side of the debate you fall on, one thing is for sure…

Credit cards should never be used to supplement your lifestyle.

Of course, cash is always your best option!

Even billionaire Mark Cuban and other millionaires strongly advise against credit cards. And they can actually afford them!

Take a look.

It’s hard to argue with the financial advice of millionaires and billionaires.

But if you do prefer to have them, then here are some quick tricks for rightsizing your credit cards:

- Contact your creditors and ask for a lower credit rate. Sometimes that’s all it takes is asking.

- Consolidate your debt onto one no-interest or low-interest credit card. Often you can do this with a simple balance transfer.

- Use either the Debt Snowball or Debt Avalanche method and pay down your debt quickly.

- Keep only one or two cards available once you’ve paid them all off.

As for the remaining cards, you don’t need to cancel them. Having an open account with a zero balance improves your credit score.

But, you should cut them up or freeze them in ice, so that you’re never tempted to use them.

Now if you’re not convinced that you can live comfortably without using credit cards, then don’t worry.

Here’s a post by My Debt Epiphany that may help you understand and manage them better. Credit Cards Are Not Evil: Don’t Make These Common Credit Card Mistakes.

The Takeaway

So I know the idea of downsizing may sound like you’re giving up something.

And the truth is — YOU ARE!

You’d be giving up:

- Excess bills.

- Excess debt.

- Excess money stress.

And who wouldn’t want to give up those things!

Fortunately, you don’t even have to think of it as downsizing your lifestyle.

Instead, keep in mind that you are rightsizing your life.

That is why the minimalist movement has taken root.

It means that people understand that the usual way of doing things isn’t working.

And that it’s time to try something different.

So don’t get left behind!

Purge some of the excess stuff in your life that are weighing your finances down.

Because now you know that it is possible to live in comfort without focusing on extravagance.

So tell me, what do you think about rightsizing?

Leave a comment below. I’d love to hear from you!

I love the term “rightsizing”! It’s great advice for those who are just moving out and looking to purchase a home and a car. I find it would be harder for those who already have these assets to downsize. It’s a big decision but most likely the best decision to rightsize. And yes I would definitely choose the cash over the car 🙂

You’re correct Minda, it is harder to downsize but only from a mental perspective.

We are all certainly capable of downsizing, we just have to be willing to do it.

But for people struggling with debt, it is definitely worth it to rightsize your life. Especially if you ever want to achieve debt freedom and less money-related stress. Thanks for commenting.

I never thought of it this way. I am still in the earlier stages of my and do not have a lot but this is an eye opener.

Oh, so glad I caught you in the early stages before you go down the rabbit hole of debt, misery, and stress. Keep your eyes open and thanks for commenting.

Love this! As a person who grew up in a volkswagon van, I spent many years accumulating things….including a big house with a white picket fence. Now that my kids are grown and will soon be out of the house, the topic of downsizing has come up…but i really like the way you said ‘right sizing’ instead!

You know the reason I like rightsizing is because it carries a more realistic instead of a negative connotation. I really wanted to get across the idea that you’re not giving up the good stuff, you’re just living comfortably. I’m so glad you enjoyed my perspective and thanks for commenting.

Love this idea of rightsizing as well. We as a family are undertaking a lifestyle shift to buy less stuff. Our motivation isn’t financial, we’re trying to be more eco-conscious, but I do expect a side effect to be less wasting money on unecessary things. Great tips, thanks!

Eco-conscious is absolutely a great reason for rightsizing your life. And on top of wasting less, you’ll undoubtedly still get the pleasant benefit of saving more money. So I guess you guys will just have to suffer with the torture of having extra cash, lol!

I definitely agree with the shorter term mortgages and car loans, it saves so much in interest!

Exactly! And interest is a major drain on finances. Thanks for commenting!

This is all really great information and gives us so much to consider but something really stood out. You suggested buying a home you could afford on one person’s income. Not only is that a great idea for all the reasons you talk about but statistics show that a huge percent of the population has less than one paycheck in savings and could be one paycheck away from being homeless. If people budgeted based on one income, they could find ways to still make things work if one of the household members became unemployed. It would be one more great way to make sure your family is secure. Thank you for sharing so much great information!

You are very welcome Melissa! And you’re absolutely correct! People automatically buy homes based on both incomes so that they can get more house. The downside is that more house comes with more of everything else, ie…taxes, insurance, problems, debt, etc… Back in the 1950s people lived quite comfortably on one salary. And my husband and I also did it and we are now both Debt-Free!

I always had a thing for fancy cars, but since I really started to pay more attention to my “wants” and my “needs” I have a clear point of view about why I don’t actually need one. Great post.

Yes, fancy cars do look nice, but they also come with a hefty price tag. So, for now, I’ll just enjoy the way they look from afar. Thanks for your comment!

DeShena,

Fantastic article! I love the term, rightsizing! I’m going to start using it from now on! My husband and I are doing that right now. We have moved into a much smaller home. We hopefully will be out of debt by end of 2020 or so. I have been writing about our small house living journey on my blog, too. I think we have a lot in common, and plan on subscribing to your blog! Check mine out too, and tell me what you think!

Diane

Hi Diane,

I’m glad you enjoyed my post. Great work on being so close to your goal of getting out of debt! I tried to look for your blog but not sure I was in the right place. I couldn’t locate anything related to your small house living. If you leave me the web address, I’ll happily check it out. Thanks so much for your comment! 🙂

Yes I agree so much about purchasing your first home. As a realtor, I advised all my first-time homebuyers to live within their means. There’s no reason to have to buy a 3,000 sq ft home just because you can! I usually save my clients $100K+ easily when they take my advice.

Excellent Beth! Good to know there are some realtors out there that more about the buyer than just making an easy buck. Keep giving out that great advice!

This is such a great post! I really loved your differentiation between savings and emergency fund! My husband and I are suuuuper organized with our finances and can 100% relate to many of the points in this article 🙂 awesome tips!

Thank you so much Karissa! I’ve learned that you have to be very organized with your money or expenses can get out of hand quickly. Thanks for commenting.

Love this idea really works if done well. Thanks for sharing

Yes, the idea definitely does work and it helped me to reach debt freedom! Thanks for your comment!

I love this! I’ve never heard of the term “right sizing” but I like it and I’m going to remember it!! 💜 We also treat everything as if we live on one income. Being, “trapped” is such a huge fear of ours, and doing that literally divides those off in half lol.

Thank you for sharing this! 💜

Good for you Adriana for living on only one income! I know it’s hard to do for people who are already overextended in their finances. And I’ve been there…almost. We lived on 1.5 income b/c I worked, but not much. So the trick is to let go of the idea of an extravagant lifestyle and focus on living a comfortable, stress-free life! And like I said in the post, I never feel like I’m missing out on anything! Keep up the good work!

Rightsizing is an awesome term! Really great information too, savings and an emergency fund are crucial to “financial freedom” but a large percentage don’t even have $400 for an emergency!

I agree that rightsizing is an awesome term! It is unfortunate when so many people can’t cover a $400 emergency. And I’ve been there! So I can testify that having an emergency fund provides a sense of financial well-being and security. Thanks for your comment!