Every month it’s the same thing.

It’s time to pay the bills, and you’re stressing out!

The thing is, you go to work every day. You make a decent salary.

And you try hard to provide a better life for yourself and your family.

After all, that’s the American dream, right?

Yet every month you look down at the table and see a stack of bills three inches high glaring back at you!

Each one of them chomping like Pac-Man to take a big bite out of your rapidly dwindling paycheck.

That’s when you find yourself asking the same burning question as last month.

How am I ever going to make ends meet?

Deep down inside, you know that you’re only one mishap away from financial disaster!

And each month you face the same terrifying realization.

That you’re not even living from paycheck to paycheck.

Instead, you’re living from prayer to prayer!

Then you wonder, how did things get this bad?

Table of Contents

The Problem: How Can I Make Ends Meet?

I asked a recent business school graduate that question.

The graduate’s response was simple, “You need shorter ends.”

Huh?

That sounded like an intellectually, unhelpful, oversimplification.

But then, I thought about it a little further.

That’s when I realized that the answer was only deceptively simple. And it actually makes perfect sense.

Here’s the gist.

Earn $10/hour – spend $12/hour = short on money!

Earn $10/hour – spend $10/hour = ends will meet (i.e. shorter ends)!

Earn $10/hour – spend $7/hour = money in pocket!

Personally, I like option number 3 the best!

But, I know what you’re thinking.

That’s not a new concept.

And you’re absolutely right!

But, it is perhaps a different way of thinking about your financial situation.

Take the couple in this next video for example.

They are clearly in need of a new money perspective.

First off, they hadn’t made a mortgage payment in TWO YEARS!

I know, hard to believe, isn’t it?

So they contacted businessman Victor Antonio (previously of the show Life or Debt). Because now they were in “deep doo-doo” and needed help fast.

But do you know what their biggest problem was?

You may think it’s their extravagant tastes, or that they spend money as if grows on trees.

Certainly, those are areas of serious concern.

But no, their biggest problem is how oblivious they were to the fact that their money situation was on financial life-support.

Take a look.

Okay, so here’s the recap.

The family is $300,000 in debt! They haven’t made a mortgage payment in 2 years.

The wife has a closet full of designer shoes, handbags, and a fur coat.

According to Victor, she probably has enough merchandise to pay for all their missed mortgage payments.

But she wasn’t eager to sell anything.

To top it all off, they still bought a $12,000 timeshare only six months early.

I have no words!

Since the couple was on the verge of losing their home, Victor suggested they sell off some high-dollar items quickly at auction.

They hoped to collect enough money for at least two mortgage payments.

Then, they could then use that money to show good faith as they try to negotiate with their mortgage lender.

WELL! Here’s what happened next!

Unfortunately, they didn’t get as much money as they were expecting.

And when a $750 purse sells for $130 and some Chanel boots sell for only $55, the wife gets angry and walks out.

Next thing you know, the husband goes ballistic!

Yikes!

And let me tell you, things just continued to spiral downhill from there.

Of course, it sucks to get less money than you paid for something. But as the old proverb says:

“Desperate times call for drastic measures.”

And to paraphrase one of the comments left by a viewer of the show…

“When you need to feed your family– you take what you can get! Otherwise, you can eat the purse!”

The bottom line is that the couple was not prepared to make the hard sacrifices.

The husband even suggested that Victor contact the bank and work out a deal. He wanted to make the majority of those missed mortgage payments disappear.

Well, I don’t know if he was serious or just upset.

But sometimes it seems like that is what people expect.

They want someone to wave a magic wand to make their money mistakes magically disappear.

Wouldn’t that be AMAZING?

Unfortunately, unless you win the lottery or have a fairy godmother — that’s probably not going to happen!

So the best thing you can do is get mad as heck, take action, and start turning things around TODAY!

Then, in 1 year, you can have:

- Less debt

- Less stress

- Better financial security for yourself and your family

OR, you could just be 1-year older!

And you’ll still be asking the same question, “how can I make ends meet?”

Fortunately, I’ve got your answers are right here!

Now, be warned. They’re not always easy. BUT, they do work!

Also, keep in mind that it may take more than one solution to fix your money problems.

But, the good news is that these are tried-and-true methods. And they have helped lots of people, including me!

So let’s dive in.

The Solutions: 5 Ways You Can Make Ends Meet

1. Renegotiate your rent to make ends meet

Did you know that you can negotiate almost anything, even your rent?

That’s right. Some people may not realize it, but the rent is negotiable.

And even if you can only knock $40 a month off your bill that still adds up to $480 saved per year.

Now, that doesn’t mean that you can go to your landlord or rental office and say, “Hey, I want a lower my rent!”

That may not work!

But, here are a few quick tricks that just might:

- Speak directly to the owner or manager. Office workers may not have the authority to lower rates. So if they say it’s not possible, then ask for someone higher in the chain of command.

- Have a price range in mind. Research to find out the highest and lowest rates for similar apartments in your area. Then, negotiate for a price lower than what you’re willing to pay. For example, if you want your rent reduced by $100, then ask for $150. Hopefully, they’ll meet you somewhere in the middle. But if they seem too stubborn to budge, then ask what amount they would be willing to accept. Anything less than you currently pay is still a win.

- Talk yourself up. Mention your history of paying on time. And how you’ve always followed the rules. Also, of your number of years as a perfect tenant.

- Offer to give something in return. Maybe you can agree to sign an extended lease (if you plan to stay there for a while). Or, to give up a coveted parking space. You can even offer to refer a friend.

- Ask if they have any available deals. It is possible that they could offer discounts for students, educators, veterans, etc.

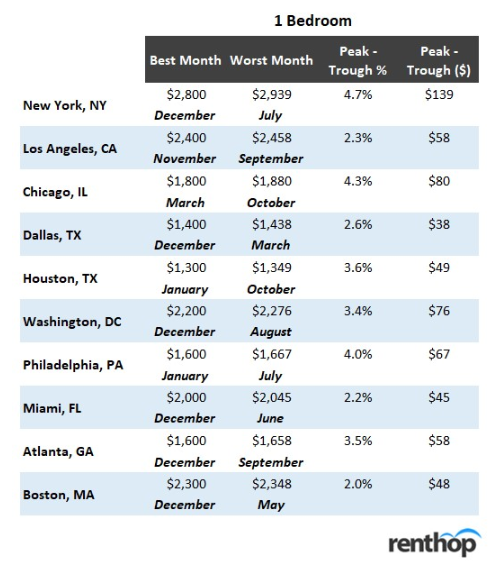

- Winter months are the best time to negotiate. According to a Renthop, December is the best month overall for getting the lowest rates.

- Consider rightsizing to a more affordable alternative. You may love where you live, but your money may not. And if your landlord is unwilling to compromise, then that’s the cue it’s time to leave. Also, just in case you missed it, read my post on How To Save Money By Rightsizing Your Life. It may give you the motivation you need to make the best money choices for your family.

2. Contact your mortgage lender

As you saw from the videos earlier, if you are behind on your mortgage payments, then you are not alone.

In fact, a whopping 38 million Americans can’t afford their homes!

That is not only mind-boggling, but it’s also sad!

And, it validates the point that people are overly idealistic about their finances.

Fortunately, however, homeowners do have plenty of options.

First, start by contacting your lender immediately and explain your circumstances.

But, be warned — the clock is ticking!

And the longer you wait, the fewer options you will have.

Next, try working together with your lender.

Determine which of these solutions may be available to help you begin to make ends meet.

- Repayment plan. This option is an excellent way to handle any missed payments. First, it divides them up. Then it adds those smaller portions to your current monthly payments over a certain number of months until you catch up.

- Forbearance. This option was a Go-To for me when I had student loans. It works by reducing or suspending your mortgage payments temporarily. And the cool thing is that it could even be as long as a year.

- Refinancing. Like I said earlier, mortgage payments can eat through your money like Pac-Man. So refinancing for a lower interest rate could save you hundreds of dollars per month. But, keep in mind that this could involve a credit check. So do this quickly before your credit score takes a nosedive due to late or missed payments.

- Mortgage modification. If you’re already at risk of foreclosure, you may qualify for the Home Affordable Mortgage Payment (HAMP) program. This program has helped families lower their median payments by more than $530 per month. Wow! Talk about a life-saver!

- Speak with a HUD-approved counselor. These counselors are not just for low-income families. And they are available if you want to talk with someone other than your lender. They offer advice on renting, buying, foreclosure, defaults, and even credit issues. Plus, it never hurts to get another free professional opinion about all your options.

3. Get control of your spending to make ends meet

Thinking back to the couple from early.

One thought comes to mind.

Someone should pour holy water on whatever dark forces were possessing those good people to spend money so carelessly.

But all kidding aside, debt is no joke!

And sadly for that couple, their problems run deep and possibly even border on addiction.

Hopefully, for you, the money problems aren’t quite as severe as they were for that couple.

BUT, obviously, you have realized one undeniable fact.

Your current spending habits ARE intensely affecting your ability to make ends meet.

Sometimes it can be difficult to pinpoint exactly what you’re doing wrong.

My blogger friend over at Speaking of Cents wrote an interesting article on The Bad Money Habits That Are Making You Broke.

It may help you identify the money mistakes that you’ve been making — knowingly or unknowingly.

Ideally, one of the best things you can do to combat bad money habits is to give every dollar a job.

And it’s simple to do:

- For starters, set aside time today and one day every week to list all your necessary expenses. That would include housing, food, utilities, insurance, and basic transportation needs.

- Then, list your total bi-weekly or monthly take-home pay.

- Next, designate where each dollar will go before you ever spend a dime.

- Finally, set up automated payments for any fixed expenses. Especially your mortgage or rent! You’ll have to pay for it anyway if you’re going to continue to live there. So it’s better to ensure that your payments are always on time. And, you’ll never have to worry about late fees.

Following these steps will help you get a realistic picture of your expenses. And, they will also give you a better handle on your money.

Truthfully, I can’t express enough the importance of being able to see your expenses versus your income in black and white.

That’s why I’ve used a budget journal every week for years similar to the ones shown here. Each one is a best-seller, and is jam-packed with helpful tools!

It is one super simple way that I stay organized and on track with my finances.

4. Don’t be afraid to ask for help.

Have you ever heard this expression?

“A closed mouth doesn’t get fed.”

Let me give you this bit of compassionate yet crucial advice.

When your bank account is starving for money, or you’re on the brink of losing your home — then it’s time to open up and say, AAAAH!

Seriously! You have to swallow your pride or whatever else is keeping you silent, and Ask For Help!

However, let me point out that nothing is going to help if you shoot down all the options because you don’t like them!

Again, going back to the couple from earlier.

Since they were dangling off the edge of a foreclosure cliff, they wanted to file chapter 13.

So Victor brought in an expert that created a road map for the family to prepare for bankruptcy.

But, instead, the couple allowed both fear and stubbornness to cause them to deviate from the plan.

And the baffling thing is that they ended up renting another house for $2,200/month, which was $1,000 more than their original mortgage.

Wait…what?

They did that while trying to file for bankruptcy and still never made a single mortgage payment.

Needless to say, that didn’t go over well with Victor or the bankruptcy expert.

And here’s what happened next!

So the final result?

The couple refused to embrace the help being offered, and Victor had to part ways with them.

Now, that brings me to my purpose for using this couple as an example in the first place.

I wanted to drive home a critical point.

Finding ways to make ends meet when you’re already in a financial crisis is no day at the beach!

It’s not going to be pretty.

It’s not going to be easy.

And sometimes, you may not like the answers.

Despite all that, making ends meet is entirely doable.

But you have to be open and ready to accept the advice or help that is being offered.

So to that point, here are additional places that you can also seek help to make ends meet:

- Use your EAP. Many employers offer free, confidential employee assistance programs. Their goal is to help families in crisis, including financial difficulties.

- Contact The National Debt Hotline. It also offers free financial counseling and resources. In addition to that, there is a nonprofit credit counseling agency (www.nfcc.org). They may even be able to assist you with getting lower rates and lower payments on your credit cards.

- Look for government help. Benefits.gov is an online resource. The questionnaire helps determine if there are any state or federal programs available for your situation.

- Check with local churches. Many often have funds set aside for families struggling to make ends meet. Also, check out Rent Assistance. They work to locate charitable programs and subsidies in your local area.

5. Supplement your income

When you need to make ends meet, you have to pull out all the stops!

And that includes anything that can boost your income.

You may already know about options like driving for Uber or Lyft.

But there are so many other alternatives available as well.

I’m doing a post specifically geared towards ways to find money that can help to make ends meet.

However, for now, here are two quick things you should definitely try:

- Sell the excess. Remember the wife’s closet from the video? She had thousands of dollars worth of accessories that she could have sold for quick cash. However, I would probably keep the auction as a last resort. But other places like Craigslist or eBay are great ways you can earn more money for your merchandise.

- Pick up extra shifts. If your company allows overtime, don’t leave any money on the table — grab it! They may even offer more money per hour for working nights, weekends, or holidays.

On top of that, I also wrote a post on the 12 Great Paying Ways To Earn Money Fast. It provides more valuable quick money alternatives.

Plus, here are some empowering books with great money-making and budgeting advice.

These are staples in the personal finance and all have rave reviews! So far I’ve started reading the first two.

The Takeaway

Every month you find yourself asking the same question, “what can I do to make ends meet?”

The good news, is that being able to make ends meet is entirely possible!

The bad news, as I demonstrated with the couple in the video, you might not like all the answers.

However, I’ve shown you that some of the best options would be to:

- Renegotiate your rent

- Contact your mortgage lender

- Control your spending

- Ask for help

- Supplement your income

So the next question becomes:

Are you ready to do what it takes to save your family from the brink of financial disaster?

Of course, you are!

But, to do that, first, you’ll have to:

- Face the truth about your finances

- Make some hard sacrifices

- Be open to accepting help

OR, you can ignore everything you just read!

AND, you can keep stressing out over bills month after month after month!

However, I know you’re sick and tired of doing that.

So why not take it a step further?

Now, are you ready to take the first step toward feeling better about your finances?

Great! Then, I’m happy to help!

I’m happy to gift you a FREE, NO JUDGEMENT Financial Breakthrough call. All you have to do is click the link below.

Soon, there will be nothing stopping you from making your end meet with ease and comfort!

Wow. This is strict, but oh so good. I had to take a difficult approach at one point in my life, college debt, playing too much. It wasn’t easy, but I did it. I wish I had your advice at that point, it would have made it a little easier, and quicker!

Thanks so much, jennybhatia! I wish I had this advice and a receptive mind when I was younger also! It would have saved me a lot of financial grief!

Excellent post and interesting too! Pinned for later 🙂

Thanks for stopping by!

Many people “Go Down” just because they do not ask for help and when thy are offered they do not accept it. They are in DENIAL through and through and past a certain point, it becomes too late. I love the addition of videos in your post. Very well written DeShena.

Thanks so much, Nadia! And you’re absolutely right that denial only makes an already bad situation, worse!

Very good tips. I have had to do some of the things mentioned after my divorce. Especially picking up an extra shift when I got a second job. Thanks for sharing.

Thanks, Anthea! Sometimes we have to make a few sacrifices in the present for a better future! Thanks for your comment!

All great tips to take control of your debt! As always, the first step is admitting there is an issue and be willing to ask for help! We started teaching our kids when they were young that we only use the credit card if we can pay if off every month. Now that they’re teenagers, I’m really hoping that constant reminder sticks! Our son is working and going to college, and is taking a good chunk of his paycheck to pay off his car, so that’s definitely a win!

Excellent job of teaching your kids early about be responsible with credit! Sounds like your message has made an impact on your son. Thanks for sharing!

You provide excellent advice on how to get off the hamster wheel of debt. I’d love to hear your thoughts on repaying student loans.

Hi Kimberlie, you better believe I have thoughts on student loans!! I’ll have to move that topic a little higher on my list of posts to tackle. Stay tuned! Thanks for your comment!

Getting the side hustle on is so very helpful as well. I think more people should know this

Absolutely! I will be doing a complimentary post regarding ways to find money to help make ends meet.

Today, considering the fast chosen lifestyle that everyone is having, credit cards have a big demand throughout the market. Persons from every arena are using credit card and people who are not using the credit cards have prepared to apply for one. Thanks for sharing your ideas about credit cards.

One thing I have actually noticed is there are plenty of misconceptions regarding the banking institutions intentions if talking about foreclosure. One myth in particular would be the fact the bank prefers to have your house. The financial institution wants your money, not your own home. They want the amount of money they lent you with interest. Preventing the bank will simply draw any foreclosed final result. Thanks for your posting.

Yes, I’m sure you’re right that banks would much rather have your money than deal with the house. Thanks for sharing.

Howdy! I could have sworn I’ve visited this site before but after looking at a few of the articles I realized it’s new to me. Regardless, I’m definitely pleased I stumbled upon it and I’ll be bookmarking it and checking back regularly!