It sucks not to have enough money to pay all your bills!

I can certainly remember many days where I had to rob Peter to pay Paul.

And of course, sometimes crappy things happen! You know, like an injury, a job loss, or even something as unbelievable as a freakin’ pandemic. I mean, seriously?!

But, does your landlord or mortgage company care? Not really!

Can you put those reasons into an envelope and mail them as your payment for the month? Not a chance!

The truth is that it really doesn’t matter what’s going on in the world, rent is still due, utilities are still due, and you still need money for food!

Yeah, yeah, we all know about cutting subscriptions, canceling memberships, and slashing non-essentials. But, what if you’ve tried that and it still isn’t enough?

The bills keep stacking up, and you’re worried that you’ll get so far behind that you’ll never catch up.

Hey, you are not alone! Since the pandemic, reports have shown that Americans across all income levels are struggling with money like crazy.

And when the walls are closing in, you begin to feel desperate for any quick-fix solution that you can get!

But hold your horses!

Before you do something drastic, I have to warn you that even when you’re in the midst of a money crisis…

Table of Contents

There Are 5 Money Mistakes You Definitely CAN NOT AFFORD TO MAKE!

And the number one reason why — is that they will only make your money problems WORSE!

You’re probably thinking that they can’t get any worse. But, OH YES THEY CAN!

I’ve seen it!

So, the first thing you need to do is:

1. Avoid These Money Pits Like The Plague!!

What am I talking about? Those dreaded payday loans, of course!

Listen, I’ve been down that payday loan rabbit hole before. And let me tell you, it crippled my finances far more than it ever helped!

Check this out. The lowest average annual interest rate on a payday loan is about 391%. Can you believe that?

And you’ll only be lucky enough to enjoy that low rate IF you can miraculously pay back the loan in just two weeks. (BTW, most people can’t!)

But, if you can’t pay it off in 2 weeks, then the interest rate skyrockets by nearly 30% on whatever amount you still owe. So now, that brings the interest rate up to 521% APR in only one month. OUCH!

So, what does that look like? It means a $300 loan will charge approximately $45 of interest in 2 weeks. But, if you can’t pay it back, it gets rolled over for another 2 weeks, which adds another $45. Now, it will end up costing $390 in just one month.

Huh!

Yeah, that’s why it’s called predatory lending. So now, you owe more money than when you started! Sadly, they are not there to help you. Their sole mission is to bleed your money dry!

Uhh, no, thank you! Trust me, it is not worth it!

2. Steer Clear Of This Trap Or Suffer The Consequences

The same dire warning from above also applies to car title loans. Sure they may not charge quite as much as payday loans. But, they are still known for having notoriously high-interest rates.

It’s hard not to be tempted by their juicy offers. All you have to do is bring them your car title, they’ll give you quick cash, and you can still keep your car.

But hey, don’t fall for the Okie-Doke!

First of all, they’ll charge you interest rates higher than 300%. Secondly, they hit you with application fees and processing fees.

Then, if you can’t pay the money back in about 30 days, you’ll have to pay extra extension fees and late fees.

Plus, if it turns out that you can’t keep up the payments, you could lose your vehicle and get reported to the credit bureau for a repossession.

And get this, I’ve personally known at least two people who have lost vehicles due to car title loans (smh).

So, that’s another big no-no!

3. Never Do This With Items You Love

Okay, maybe things have gotten so bad that you’re looking for items to pawn. But when it comes to the pawnshop, there’s a right way and a wrong way to do things.

Unfortunately, most of us go about it the wrong way.

First of all, never pawn items that you love, because you’ll go broke trying not to lose them!

For example, one couple that I coached was behind on every single bill. On top of that, they had two items sitting in the pawnshop for months at 180% APR!

Now admittedly, that’s much lower than the other two money pits that I mentioned earlier. BUT, the interest rate was still outrageous! So, it was crippling their ability to catch up on their other bills.

One of the items they had pawned was the wife’s wedding ring, which she absolutely did not want to lose!

But, as soon as I saw the interest rate they were paying, the pawnshop became public enemy #1 on our debt hit list!

And fortunately, by the time we finished coaching, we accomplished our goal. Both items out of hock! Yipee!

After that, I had them ask for a payment history from the pawnshop. I wanted to help them avoid falling into that trap again.

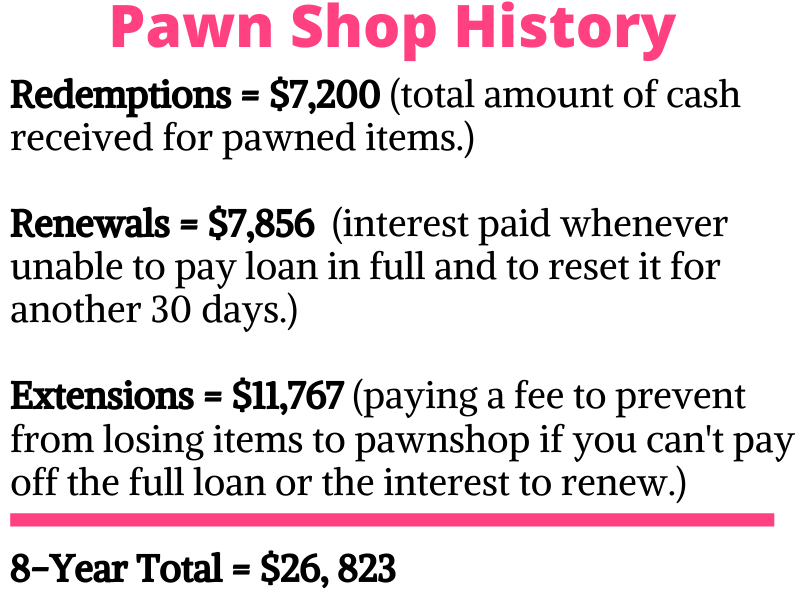

So check this out. Here’s their 8-year breakdown:

Their jaws dropped when they heard that total. And truthfully, so did mine!

The wife admits that she never wanted to know the truth before because she was so ashamed. But here’s what she says now:

“This is exactly what I needed to see because that will keep me out of there! I will never, ever go back, because it’s a slippery slope! You know, when you feel desperate, you make bad decisions. You think to yourself:

- I’m desperate.

- I need it!

- If I don’t do this — what else will I do?

But, once they get a hold on you, it’s hard to get out of that hole.”

Yes, that is sad — but true!

That why getting your money straight is crucial! And I created a Free Playbook to help you know precisely what you should focus on to get your finances on track. Click the link below to get your free copy!

4. Don’t Make Promises Your Money Can’t Keep

Speaking of slippery slopes, borrowing money from family or friends is definitely another one to avoid.

If you’ve been thinking about borrowing money, there are so many compelling reasons not to do it.

First of all, you’re putting the person on the spot. For instance, I know it makes me feel uncomfortable when people ask me to borrow money.

So now, the relationship has become awkward.

Secondly, if you’re honest with yourself, you know things are already tight. So, how will you find the money to pay them back? I mean, is it going to magically fall out of the sky? Not likely!

Here’s a perfect example of what happened to me.

I had a family member who promised, promised, promised to pay me back in one week.

Fast forward 7 years later…

I had not seen nor heard from that person in all of that time until we came face to face at a family funeral.

Both of us acted like nothing ever happened, and neither of us brought up the money thing.

I think the family member hoped that if enough time passed, I would forget.

But let me tell you when you owe people money, chances are they didn’t forget.

The worst part is that when I loaned that money, I was living paycheck to paycheck like everybody else.

So, I actually used my grocery money to help that relative out. However, I didn’t hold a grudge. And fortunately, we didn’t starve!

But what I did learn was to never lend money that you can’t afford to give away. Instead, if you want to help someone and have the money to do it, it’s better to just gift it.

And never expect to see that money again!

5. Prevent This Convenience From Becoming Inconvenient

This brings me to the next crucial money mistake. Although a cash advance is certainly the lesser of all the other evils mentioned above. But, make no mistake, it has a dark side!

And once again, I’ve experienced it first-hand.

Years ago, I was in over my head with bills. And there were many times when I would run to the ATM to get cash advances on my credit cards.

BIG MISTAKE!!

At the time, I thought a cash advance was a lifeline to help me make it to the next payday.

But actually, it only made my money problems worse because I ended up being faced with:

- Higher interest rate charges. It’s basically the same as taking out a high-interest loan at 25-30%.

- No grace period. Interest begins accruing immediately instead of in 30 days.

- Cash advance fees. The typical fee is about 5% or $10, whichever is greater. For example, if you take out $1,000, you instantly owe back $1,050, which is 5%.

- ATM fees. If using an ATM outside of your bank network.

- Indefinite payback time. With no payback time limits, if you only pay the minimum payment on $1,000, it could take you 5 years to pay that off.

In other words, getting a cash advance is like putting a bandaid on a gaping wound that keeps oozing money.

Yeah, not a good thing!

So here are some better money alternatives when you’re back is against the wall financially:

Seek These Other Money Opportunities

Instead of looking for quick loans, seek out opportunities to earn more cash. Even while many industries are laying off, there are many others where the job opportunities are booming.

For instance, consider retail, shipping, and delivery jobs. Many companies like Walmart, Amazon, and Instacart need workers for their warehouses and distribution centers.

Perhaps these are not the jobs you usually do, but they may only need to be temporary. So it’s worth considering until you can get your money situation under control.

Prioritize What Comes First

Here’s a great rule of thumb in personal finance. You always need to cover your four walls. That includes food, shelter, utilities, and transportation.

According to experts, food is always the number one priority! Everything else is negotiable.

If you don’t know where to start, you can check out the Consumer Financial Protection Bureau. They have tools to help you track and prioritize your bills.

Choose Better Options To Make Quick Cash

When you’re feeling desperate for cash, there are plenty of places to sell your excess stuff. For instance, Facebook, Letgo, eBay, and Offerup.

Then, of course, there’s also the old standby of having a garage sale. However, what if you’re leary about garage sales due to the pandemic and social distancing? In that case, you may think of the pawnshop as an easy solution.

But, if you choose to go this route, then here’s the trick. Don’t pawn! Instead, sell any items that you CAN live without.

As I said earlier, never pawn items that you value! For instance, your wedding ring, a treasured family heirloom, or your pricey laptop.

Those are items that you won’t want to lose. And when you’re already in a deep financial hole, how will you find money to retrieve them?

So, you’ll keep paying for extension after extension after extension.

AND THAT is how the vicious cycle starts, just like what happened with the wife from earlier!

Don’t Overlook This Low Cost Resource

Here’s some good news, credit unions are more willing to approve people with bad credit.

They don’t focus as heavily on credit scores. Instead, they tend to pay more attention to your overall financial picture. For instance, your income, debt to income ratio, and cash flow.

Basically, they assess your actual ability to repay the loan and not rely solely on a credit number.

Plus, the loans usually have some of the lowest interest rates you can find. They also offer more extended repayment schedules than payday loans or title loans.

Don’t Be Afraid To Reach Out

As I mentioned earlier, many families may have recently hit a bump in the road with their finances.

And there’s no shame in asking for help. The thing is that you just need to make sure you’re asking the right people.

The good news is there are always local churches and charities willing to lend a helping hand.

I’ve seen many organizations like food banks, the Salvation Army, and the United Way really step up when community members are in a bind.

You can even receive confidential help for affordable housing, paying rent, and utilities. Visit the website 211.org, enter your zip code to connect with free services in your community.

Make The First Contact

Don’t wait! When you call your creditors first, you’ll most likely speak with someone in customer service which may be willing to work with you.

But, if you wait until they start calling you, then you’ll be speaking with someone calling from collections. And their job is to collect money, not to maintain you as a customer.

Also, if you’re experiencing money problems related to a hardship, it’s crucial to let creditors know. For instance, during the coronavirus pandemic, you may still have some protections under the CARES Act.

So, when you call, make sure to say, “I’m experiencing money problems because of Covid-19.” Or, if you’re having a different type of hardship, be sure to specify that issue during the call.

The Bottom line

Not having enough money to pay for rent, utilities, and food is enough to make anyone feel desperate!

And it’s super easy to make bad money decisions when you’re desperate.

But now, at least you know which money mistakes you need to avoid.

Even more importantly, now you have some better options to help you lessen the pain.

Just picture a year from now once your money crisis has passed. Won’t it feel so nice to know that you didn’t prolong the agony by making a wrong decision today?

Sometimes all you need is a little guidance of exactly what steps you should focus on to finally see results. Click the link below and book a free chat.

Photo Credit: Katie Harp on Unsplash

This is an excellent resource! Thank you for putting this together.

Thank you so much, Niki! I’m glad you enjoyed it!

I love, love, love this!!

I especially related to the point about not lending money you can’t afford; I’ve been stuck in the same boat as you for about 2 years— but as you said, I WON’T FORGET!

These are some really valid points, and I love your style of bringing them across.

Thank you so much, Karema. Yes, that’s another lesson I learned the hard way. Never lend what you can’t afford to give away. We just have to say, I’m sorry but I don’t have it.

This is such an excellent post. I completely agree on holding on to things you love.

Thank you, Ashley! Yes, that was a lesson hard learned!

Wow! This was so helpful. My husband and I have lost a few things to pawn shops. But now if I can get him to listen I will be able to prevent anymore unwanted losses. Thank you

Hi Brittney, been there! I’ve lost a thing or two in the pawn shop before as well. The worst part is that I paid the pawn shop a lot of money trying to hold on to the items and still lost them in the end. It’s a money pit and definitely needs to be avoided!

All great tips. Nothing annoys me more than an ATM fee.

Thank you and I totally agree!

Thank you so much for sharing! I am a recent university graduate trying to learn how to be smart with my money. Definitely going to remember these tips for the future!

Thank you so much, and it’s great that you’re learning early about ways to be smart with your money. Congratulations on your recent graduation! 🙂

You’re welcome! Thank you for reading!

I really like reading through a post that can make people think. Also, thanks for allowing for me to comment!

Thank you also, and you’re welcome! 🙂