Moms face unbelievable pressure every day!

We are expected to do it ALL. And, to do it all well!

Or else, we risk being mom-shamed, made to feel inadequate, or even worse, feeling like a failure.

Here’s how one mom that I coached described her life.

She takes care of the kids, husband, house, homework, extracurriculars, meals, bills, shopping, laundry (take a breath). ANNNND still has to work, to top it all off!

Ugh! Sound familiar moms?

And can you believe that despite everything she does, sometimes she still feels like a “horrible mom?”

Wait-what? You’re probably thinking — how could she possibly feel like a horrible mom, because she sounds amazing?

You’re right. She is amazing! BUT, there’s something she’s been neglecting that she fears could be destroying her kids’ quality of life!

I know that sounds a bit dramatic but, truthfully, this thing is a doozy!

It’s something that:

- Keeps her up late at night worrying.

- Has her stomach in knots several times a month.

- Causes frequent arguments with her spouse.

- Makes her more irritable and impatient with her kids.

- Sucks the life out of her spirit every day!

I can almost hear you thinking, what the heck could be causing this amazing mom such negative consequences?

Well, it’s her Poor Financial Health, that’s what!

Now you’re wondering…

Table of Contents

What Is Financial Health?

Good question.

So, the simple answer is:

Understanding how to use money as a tool to provide comfort, peace of mind, and security now and for the future.

Here’s a quick video.

Okay, you probably still have questions. No problem, I’ll break it down for you.

So, to have good financial health, it means that:

- Your basic needs are being met.

- You’re not stressed about bills.

- You have money stashed for an emergency.

- You’re actively saving for retirement.

- You have the financial freedom to afford those little extras in life.

In other words — your income exceeds your expenses — and not the other way around!

Now, on the other hand, the mom I coached found herself:

- Always behind on bills.

- Unable to survive missing one paycheck without freaking out.

- Constantly worried if she’ll have enough money to pay rent, buy food, or have gas to get to work.

- Without any money set aside for a rainy day.

- Using credit cards, loans, or needing to borrow money just to get through the month.

Aye Yai Yai! The bottom line is that her bills have her stressed out! And it’s hard to feel like a good mom, wife, employee or anything else when you’re stressed.

Needless to say, that money-related stress is a tale-tale sign of poor financial health.

That brings me to the next point…

Why Is Financial Health Important?

So, as I just described, financial health doesn’t only affect your finances. It also affects your mood, relationships, and even your self-esteem, like with this mom.

Not only that but living in a constant state of stress is detrimental to your physical health as well.

You’re probably thinking…no kidding! Tell me something I didn’t already know!

Okay! Well, did you know this? Stress can:

- Make you look old.

- Make you fat.

- Lead to heart attacks and strokes.

- Increase cancer risk.

- Deteriorate brain function.

- Weaken your immune system.

- Damage your teeth.

- Ruin your sex-life.

Okay, so did you know all of that? Well, whether you did or didn’t, here’s the big takeaway.

Think of stress as a bad guy with a loaded gun.

And your poor financial health is the bullseye. So basically, you’re inviting this bad guy to keep that gun aimed straight at your life.

I know that doesn’t seem fair. Especially if you’re like this mom who has a professional job and earns a decent salary. Yet, she’s still living on the financial edge.

And all it would take is just ONE MORE unplanned money crisis and then…

Bang! Game over. You’re financially dead.

UGH! How do we make it stop?

Not to worry! Because I’m going to share a little secret with all of you amazing moms. There is one thing you need to do to give your financial health and your mommy vibe a new life.

And that is…KNOW YOUR NUMBERS!!! The good news is, it’s not as difficult as you may think.

Here’s how you start. First…

Track Your Cash Flow

During my conversation with the mom, I realized a very crucial detail that she was lacking in her financial health saga.

She had absolutely no clue about her monthly cash flow status.

Cash flow = Money in – Money Out

As it turns out, she was paying outrageous interest rates, ridiculous fees, AND for services she didn’t even need. For instance, two Netflix accounts.

Sorry, but I have to say it — wasting money this way should be a crime!

Honestly, determining your monthly cash flow can seem a bit tedious in the beginning. But it is crucial information to know if you want better financial health.

Here’s what you’ll need to do:

- Keep track of every single expense for the month.

- Gather all your bank statements and bills.

- Then compare.

Now, if you find that there’s more money going out then coming in, then it’s time to jump into action. Slash! Slash! Slash those non-essentials expenses immediately!

Also, more than likely, you’re overspending on your monthly bills. Wanna know how I know this? Because most people don’t research or negotiate fees.

Personally, I make a game out of tracking and negotiating fees. But, I know that a lot of people don’t have the energy, time, or patience to devote to the process.

So here are a couple of options that I haven’t tried yet but have heard good things about.

- BillShark is a fee negotiating service. They can examine your monthly expenses and look for areas where you can save. Then, they negotiate for lower rates on your behalf!

- TRIM is a virtual personal assistant. It automatically helps you save money by also negotiating fees, including medical bills.

And best of all, sign-up is FREE for both!

Okay, so next, it’s a good idea to…

Determine Your Net Worth

Did you know that even when you’re in debt, you still have a net worth? No, it’s not just for the rich. And the benefit of knowing your net worth is to get a better perspective of your debt level.

For instance, if you have $50,000 in debts that can sound frightening! But, on the flip side, you may also have $200,000 in assets.

Do you see what I mean? Suddenly, your financial health may not seem as dire as you thought.

Here’s how to calculate, add:

Everything you own – Everything you owe = Net worth

The things you own could include:

- House (appraised value)

- Car (the value that it would sell for today)

- Investments (including retirement accounts)

- Collectibles (typically anything valued at $500 or more)

The things you owe could include:

- Mortgage (remaining balance)

- Car loan (remaining balance)

- Credit Card debts

- Student loans

- Personal loans or money borrowed

Now, if you end up with a negative net worth — don’t panic! This is common for many people, especially while you’re still paying a mortgage or student loan debt.

The main idea is just to know where you stand. Also, now you’ll have a starting point for tracking your progress each year.

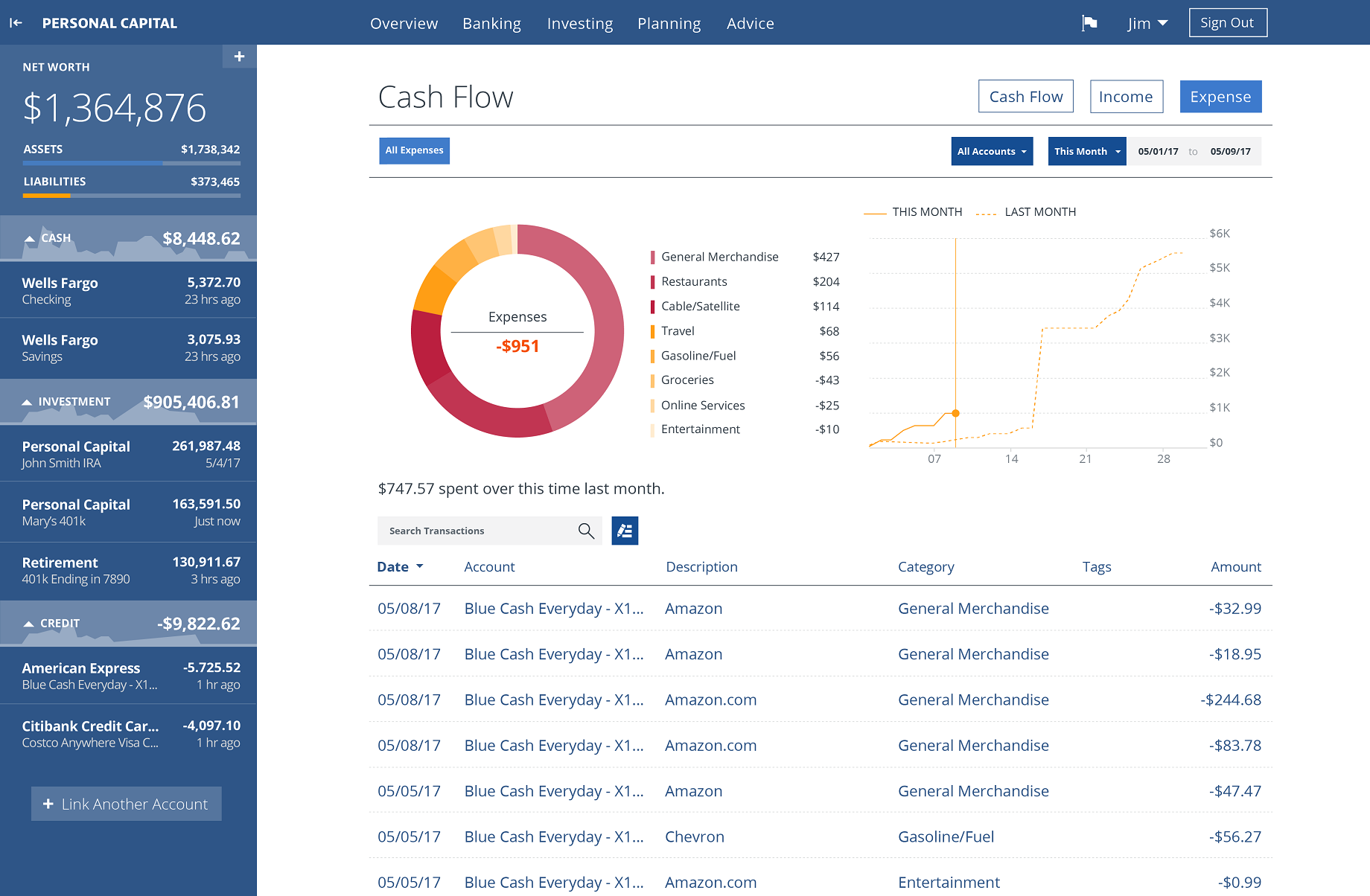

But, if you’d like an easy and holistic view of your financial picture, then I recommend trying Personal Capital. I’ve used it for years.

You can see all your accounts in one place. Track your net worth, And get financial advice. Plus, the sign up is free!

Okay, so the next thing you need to do is…

Plug Spending Leaks

Getting back to the mom, here’s another big mistake she was making. She didn’t have a spending plan. And without one, the money leaks were gushing like a fire hydrant.

Here’s the thing, a spending plan (aka budget) is simply about…

Deciding where you NEED TO spend your money — BEFORE you spend your money.

So after tracking her cash flow, we identified several large leaks! Turns out, she was spending more than $800 a month on eating out, kids’ activities, and extras. And she didn’t even realize it!

But once she identified those leaks, she was able to set an intentional spending amount for groceries. Plus, cut back on eating out and extras.

Truth be told, she’s not the only mom overspending on food and extras. In fact, statistics show that Americans spend on average, a whopping $3,000 per year eating out! And, $600 per month or more on non-essentials.

YIKES!! Luckily, there are ways to chop that food bill in half.

- Cook at home more.

- Feed your family delicious meals on a budget with websites like Two Dollar Eats or 5 Dollar Dinners

- Invest in an Instant Pot, which cooks complete meals in minutes.

Plus, 5 Dollar Dinners also has this great FREE workshop that I signed up for. You can learn your 5 biggest spending mistakes. And, you’ll get the money-saving formula to help your budget.

Once you’ve conquered the leaks, now you can begin to…

Pay Yourself First

Okay, so I already know what you’re thinking!

“How can I pay myself first when I can’t even find the money to pay all my bills on time every month?”

I totally get it! Remember, I’ve been there too! But, that’s precisely why you need to do this first.

Because what I’ve learned from experience is that without a cash cushion, things can go from bad to worse in a heartbeat! Also, if you don’t save something off the top, then you’ll never have any money left over to save!

There’s even an ingenious quote which says:

A simple fact that is hard to learn is that the time to save money is when you have some.” ~ Joe Moore

Yeah, I already know what you’re going to say, “sure that makes sense — BUT HOW CAN I DO THAT WITH NO MONEY???”

Well, here’s the secret!

First, focus on tracking your spending and plugging the leaks. The mom I coached began doing those two simple things, and within 3 months, she was able to:

- Pay all bills on time.

- Eliminate unnecessary fees.

- Cut her grocery bill in half.

- Begin to see the money stop disappearing from her bank account.

So with all the money she added back to her budget, she can now add herself to the top of the list and begin saving.

Also, keep in mind that it’s okay to…

Start Small

Even though she made tremendous progress, she still had to be intentional with her spending.

We all know that life can throw a curveball at any moment. So it’s crucial to have a cash cushion ready. Most money experts typically recommend an emergency fund of 3-6 months of expenses.

But, when you still have a ton of debt that can seem next to impossible.

*Related Post: How To Boost Your Emergency Fund.

So, the good news for all moms struggling with bills is that it’s okay to start small. My rule of thumb is to start by saving the sum of one paycheck.

You don’t have to focus on any lofty savings goals for now. Instead, it’s more important to start saving something and to develop a savings habit. The easiest way to do that is by trying to commit to saving at least 5% of every paycheck.

Heck, you can even start with $5 per paycheck! It won’t get you very far, very fast. BUT it’s probably more than what you’re saving right now.

And here’s the thing, no matter what amount you choose, the key is to start today and to be consistent.

Then, before you know it, here’s what you’ll see:

- Your savings balance moving upwards.

- Less stressing over bills.

- More confidence in your finances

- Yourself feeling like a better mom.

Now, it’s time to…

Eliminate Debt

When it came down to debt, one of the biggest obstacles blocking this mom from improving her financial health was — HER!

And while speaking with her she admitted 3 things:

- She was afraid to face the truth about her money situation.

- Her finances were so disorganized that she felt overwhelmed.

- She didn’t have a clue where or how to even begin sorting out the chaos.

Everything she was feeling is normal! Hey, I’ve been there!

And let me tell you, I know how brutal it is to face the reality of years of bad money decisions. Truthfully, it can make anyone feel like a financial failure.

But when this mom finally had enough, she summoned up the courage to face her fear head-on. Then it was game on!

She became a mom on a mission! She got serious, focused, and committed to better financial health.

And here are some of the tricks that helped her finally take back her power:

- Establishing a get-rid-of-debt plan. Use the debt payment calculator below to find out how long it may take. Then set a realistic repayment goal. My post on the 6 Surefire Steps To Achieving Your Money Goals Now can help you get started.

- Choosing a debt payoff method. This mom chose the debt snowball and began attacking her debts from smallest to largest.

- Slashing expenses. She incorporated meal prep, buying in bulk, and a temporary ban on eating out.

- Increasing income. She picked up a side-hustle driving. But you can also try working overtime, or get a temporary part-time job.

- Stopped creating any new debt! She had to cease ALL off-budget spending! This gave her a chance to allow the dust to settle and begin to see a light at the end of her debt tunnel.

Finally, make sure to:

Monitor Your Credit Score

Some experts may debate the value of credit scores. But if you’re looking for a home loan, it tells lenders a lot about your financial health.

And the mom in this story was deathly afraid of checking her score, which of course, is never a good sign.

The best option is to save up the money first for all your purchases, including your car and home.

Calm down, I know what you’re thinking — that’s unrealistic, right?

Actually, it’s not as impossible as you may think. Especially when you consider that you’ll end up paying nearly double the original home price with a 30-year mortgage loan. Check out this article to learn more about buying a home with cash.

In the meantime, when you can’t pay cash, then here’s what you need to know.

A good credit score starts at around 670 and here’s why you should monitor yours several times a year:

- Catch discrepancies faster. Identity theft is a huge problem. It can go undetected for months or even years if you’re not monitoring.

- Keeps you informed on where your numbers stand. Even if your score is low, you can take action faster to improve it.

- Shows what areas need improvement. For instance, if you have a late payment history, you can focus on being timely, which will help to boost your score.

Now, as for this mom, despite years of fear and neglect, she finally realized a few things:

- Improving her financial health was completely doable.

- She could dedicate at least one hour per week to managing her finances.

- Being consistent and intentional is essential.

And guess what?

Now she feels:

- Excited

- More in control of her money.

- Hopeful for the future.

And she also feels more like the good mom that she always wanted to be.

Financial Health Takeaway

Moms are AMAZING! And even when we try to do it all, it’s easy for some things like our financial health to fall by the wayside.

And as you can see from this story, money problems don’t just stop with the money. It can bleed into your personal relationship, cause constant stress, and even affect how you interact with your kids.

But the good news is that knowing your numbers is the first step to better financial health. So just to recap, remember to:

- Track Your Cash Flow

- Determine Your Net worth

- Plug Spending Leaks

- Pay Yourself First

- Start Small

- Eliminate Debt

- Monitor Your Credit Score

Now, you have all the tools you need to go from just barely surviving to tremendously thriving in good financial health!

AND THAT can ultimately help you start feeling like a better mom.

But, if you need help getting started like this mom did, then click here for a FREE 30-minute discovery call and let me help you get your money on track!

SO many good tips! Thanks for sharing!

Glad you enjoyed it! Thanks for your comment!

It’s amazing how money worries can impact every other area of your life. Taking charge and starting small is the best plan for success!!!

So true Kari! Thanks for your comment!

This is great financial advice. I really thinking starting small can have such a big effect sometimes just starting is the biggest thing you can do to make a life change!

So true! And it small win adds up to big achievements!

This is such a great help!!! I have been trying to do exactly this!! It does take time, but I’m slowly getting there!! Thank you for sharing!!

You’re welcome! As long as you keep making progress you will get there before you know it! I’m glad you found value in this article!

I’m not a mom but I enjoyed reading this article. It’s nice to get a perspective on the stresses mom’s face but having good financial health is important for everyone. Even us single gals! 😉

Absolutely Geneva! Everyone needs good financial health! So glad you enjoyed the article! 🙂

Thank you for this. I am working towards being debt free and this is a great resource!

You are very welcome, Valerie! Yes, please use it as a resource and good job on working towards debt freedom. It’s very liberating! Thanks for your comment!

Absolutely lovely this post. These are some really practical financial advice. I love the idea of determining your net worth it is really such an important advice. Thanks for sharing!

Thank you so much, Suktara! I’m so glad you found value in it.