I know how you’re feeling right now!

You’re a mom in debt.

And you feel like you’re dangling off the side of a cliff with one hand?

You know that at any moment, you could lose your grip and plunge straight into a financial crisis.

What’s even worse, is that you’ve tried several things to pull yourself up!

- You’ve created a budget.

- You’re tracking your expenses.

- You’ve even cut out cable. Switched to a more affordable cell phone plan. And, cut back on eating out!

But still…it’s not enough!

Especially when you have car payments, credit cards, student loans, childcare, mortgage, Insurance, and life to deal with!

So now you’re panicking!

And you know that something needs to change soon.

Believe me, I get it! Because I’ve been there — hanging on for dear life and praying for a money miracle!

The problem is that your debt has already gotten out of hand! So now you just feel stuck and lost about what to do next!

Good news!

I’m going to share with you how I successfully paid off $19,000 worth of credit card debt in 28 months.

No, it’s not the lightning fast, snap your fingers, wiggle your nose solution that we all wish it could be.

BUT, keep in mind!

That climbing out of deep debt does take a little bit of sacrifice. A little bit of time. And a butt load of Determination!

The most important thing is — to keep making progress. And to get out of debt as quickly and painlessly as you can!

So mom…Are You Ready?

Let’s begin!

Table of Contents

How To Get Out of Debt Quickly!

1. Don’t Add To The Problem!

The very first thing I had to do to get out of debt was to Stop Spending!

You may be thinking…DUH, that’s just common sense!

But what I’ve learned over the years, is that common sense — is not always common!

For instance, one of my coworkers frequently complained that she never had any money because of debt!

She even worked a full-time and a part-time job just to make it through each month.

But, despite all of her grumbling. She wouldn’t hesitate to throw her child a big birthday party at a kid’s party place!

And how did she do it? She charged it of course!

I’m sure many moms can relate to not wanting your child to suffer because of your debt mistakes.

I’ve been there as well!

BUT…

Eventually, I had to face reality.

Remember, you’re already stressing over debt!

So, if you’re going to be smart about money, then you must learn how to scale things back. That’s part of the sacrifice that I mentioned earlier?

Now, that doesn’t mean you can’t do anything!

You just need to be a little more creative. My coworker could have tried planning a small, affordable “DIY” gathering at home.

That’s what I did!

And you know what?

My kids didn’t even mind!

As long as they got some cake and a gift — they were good!

One CRUCIAL STEP of how to get out of debt when you feel stuck is…

Treat credit cards — like the plague!

I’m not kidding!

Don’t touch it! Don’t go near it! Don’t even look at it!

Bury it in your backyard, or freeze it in a block of ice if you have to!

But whatever you do, Do Not Use It!

Not even to buy groceries!

Use your debit card instead. Because that’s works the same as using cash.

And truthfully, it saved me so many times from overspending because I knew the money wasn’t in the bank. So I couldn’t spend — what I didn’t have!

Unlike with credit cards which give you a false sense of having money available.

Plus, debit cards have no interest charges!

Just think about it. There is always going to be something tempting you to spend money. Just like the mom with the birthday party.

BUT, the bottom line is, that if you keep spending — then you’ll NEVER get out of debt!

2. Assess The Damage

Facing your total debt amount can be scary!

You know, like the monster in the closet that you keep hoping will never show itself!

Personally, I remember being too terrified to know the truth.

I would just try to keep an estimate in my head…which of course was totally based on wishful thinking!

But, this is where you’ll have to be brave!

Because you can’t defeat an enemy that you’re afraid to see.

That’s why it’s imperative to know where your debt stands.

So, here’s what you need to do:

- Gather your most recent statements for all loans and credit cards. You can use these to make sure your credit report is accurate.

- Visit annualcreditreport.com. You’re allowed a free credit report every year from each of the 3 bureaus, Equifax, Experian, or TransUnion. But, don’t get them all at once! Save 2 of the reports for later, and check again in 3 months. Then again, in 6 – 9 months.

- Use CreditKarma.com to find out your free credit score. This helps determine if you can qualify for lower interest rates. Or, even for a debt consolidation loan.

- If you have student loans, check the National Student Loan Data System. You’ll be able to see all the federal student loans you’ve borrowed in one place. And for more information on how to use NSLDS click this link.

Next, add everything together.

Now you have the naked truth of where your debt stands.

Then, as Dave Ramsey says,

“Get mad at your debt and pay it off with a vengeance!”

3. Communicate With Your Spouse

The idea that opposites attract may sound intriguing when dating.

But this could be a disaster for your relationship when it comes to money!

For instance, what if you’re a saver and your spouse is a spender?

Well, you might as well lace up the boxing gloves. Because the fights over money will be inevitable…and often!

In fact, it’s one of the top reasons for divorce in America.

Mainly, because it’s next to impossible to get your finances under control if both people aren’t on the same page.

So, here’s how you start the conversation:

- Dedicate time to talk. Set aside one night each month. Then you both should agree to have a calm discussion about your financial challenges.

- No judgment allowed! During your talks, there should be no blaming or finger-pointing! This is a safe-space for addressing concerns and working together on solutions.

- Be Honest. Approximately 57% of people surveyed admit that they hide debt from their partner. But, even if you feel guilt or shame, this is the time to come clean. Because quite frankly…

Deceit can often do more harm to a relationship than the actual debt.

- Keep the lines of communication open. Regardless of how bad your spouse’s debts are, it’s important to remain supportive! Try holding hands or placing a comforting hand on your spouse’s knee. Keep in mind, it takes a lot of courage for someone to admit their mistakes. And if either partner becomes hostile, then productive communication will break down quickly.

- Make a commitment to work together.

Just like this quote, you’re not going to solve all your financial issues in one sitting. So both parties need to be willing to meet regularly. For example, make it a monthly thing and include the whole family so that everyone stays on the same page.

4. Set Realistic Debt Payoff Expectations

Going back to the whole Rome was not built in a day quote.

Unfortunately, debt doesn’t disappear overnight, unless you will the lottery of course!

But for now, you need to set a realistic and reasonable timeline for paying off your debt.

For instance, let’s look at my $19,000 worth of credit card debt.

- The number one thing that helped me pay that off was to increase my income. I’ll talk more about that in a bit.

- Next, I determined how much I could reasonably afford to pay toward debt each month.

- Then, I set a goal to pay it off in 2 years. It wasn’t going to be fun, but I knew it was doable. If you need help with setting goals, read my post on The 6 Surefire Step To Start Achieving Your Money Goals Now!

- And, I had to make sacrifices. For instance, doing home repairs ourselves. And, spending less money on Christmas, birthdays, food, and activities.

I was then able to throw all the extra money that I was earning and saving at my debt to pay it down faster.

And guess what?

It worked!

I paid off that $19,000 in 28 months! Booyah!

5. Figure Out Your Plan Of Attack

Decide which method you will use to pay down your debt.

There are a few to choose from such as the debt snowball, where you pay off the smallest debt first.

The debt avalanche, where you attack the debt with the highest-interest rate first.

Or, there is even a debt snowflake, where you make smaller but more frequent payments.

Next, decide which debt you will tackle first.

Personally, I chose the debt avalanche method. It was an easy decision since all of my interest rates were about the same…HIGH!

- First, I started attacking the debt with the highest balance. Because high-interest on high balances will suck your money dry! (I also did a balance transfer which I’ll talk about shortly.)

- On top of that, I paid a little more than the minimum payment on everything else until the first debt was paid in full.

- Then, I took the money that was going towards the paid off debt and threw it at the second debt. Along with the minimum payment.

And, the Avalanche just kept flowing from there. Until finally…all my debt was done – gone – finito!

Also, I do better when I write everything down in a debt planner. And I definitely recommend that you do the same!

You can choose something like these below which are great! Or, you can make your own.

But either way, a debt planner is the perfect tool to keep you focused.

They help you track your goals.

Plus, you get a great visual of how much progress you’ve made.

AND THAT’S how you stay motivated!

6. Stop The Bleeding

By that I mean, stop hemorrhaging money!

Because when you are paying high-interest rates for years and years, that is exactly what you’re doing!

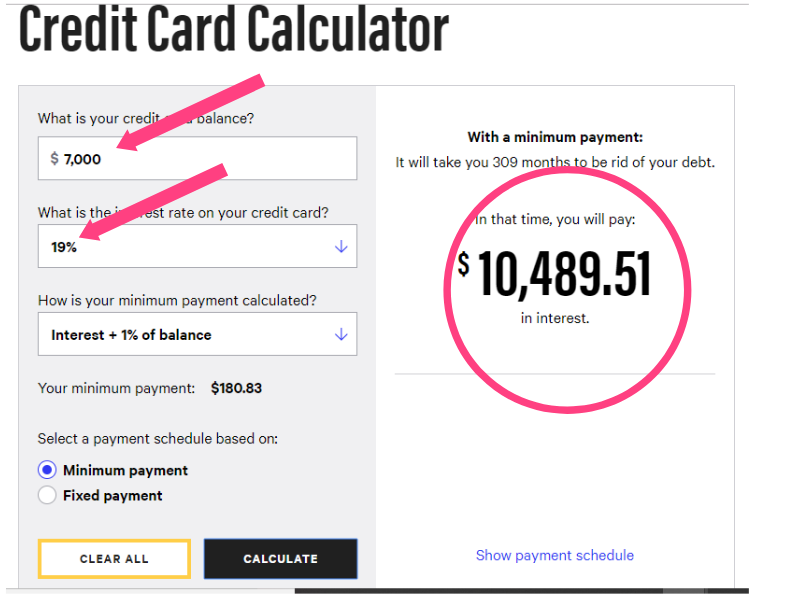

The average credit card rate in the U.S. is between 14% – 19%.

And it’s reported that American households have about 7,000 in revolving credit (the amount you carry over each month).

Just take a look at how much money you’re wasting on interest when you only make the minimum payment.

And that’s if never charge anything more!

Try using this credit card payment calculator for yourself. And get a good look at how much money you’re throwing away on interest.

So, the next thing you need to do is contact your credit card company and ask for a lower interest rate.

Sometimes all it takes is asking!

And here’s a quick video to show you just how easy it can be.

Refinance Student Loans

Another smart way to save even more money is by refinancing your student loan payment.

Personally, I missed out on this one because I didn’t know it was even an option.

Now, looking back, I realize that I paid so much more in interest over the years than I needed to.

Fortunately, you do have the option to refinance for a lower cost loan through a private lender.

To qualify, you typically need:

- A steady source of income.

- Credit scores at least in the high 600s, or better.

- A Bachelor’s degree or higher.

- Or, if necessary, a cosigner who qualifies.

Also, refinancing is available for both federal loans or private loans.

The cool thing is that you can reduce your monthly payment..which helps you pay off your debt faster!

One of the top refinancing lenders I’ve come across is Education Loan Finance (ELFI).

Here’s what I found:

- They offer one of the lowest refinancing fixed rates of all the top lenders.

- The process only takes a few minutes online.

- There are no extra costs to refinance.

PLUS, by using my ELFI referral link, you’ll earn a $100 Bonus check if you refinance within 90 days of registering!

And the best part is, that you could save thousands of dollars! Yes, please!

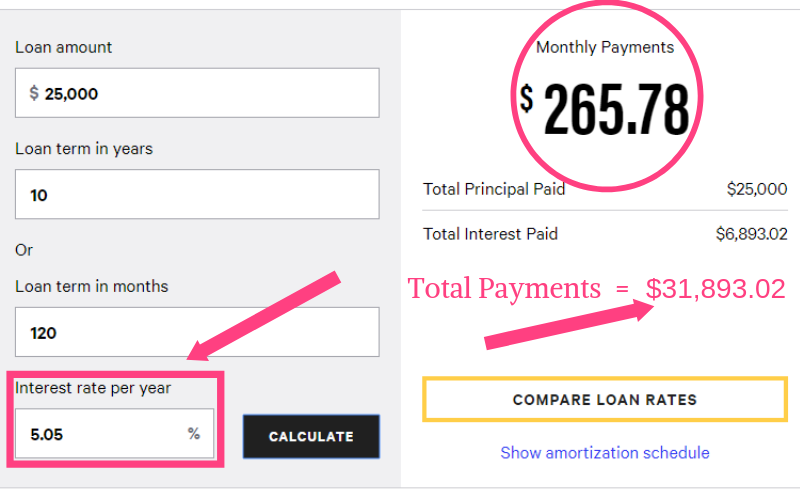

Look at this example using a standard federal loan rate of 5.05% for 10 years:

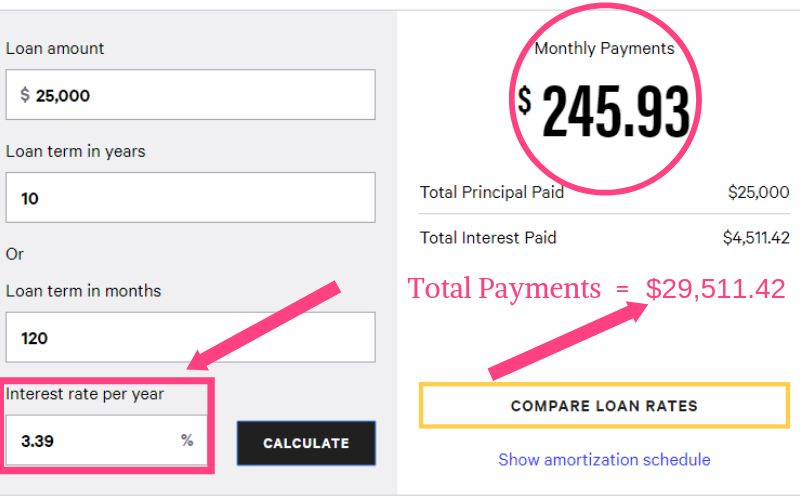

Now, look at the potential savings after refinancing.

That’s a $20 savings per month. And a $2,381.60 savings over the life of the loan.

And every dollar saved helps, right?

So, ELFI has the potential to save you thousands of dollars. They provide a simple online registration process. And, no refinancing fees!

Oh, and let’s not forget the $100 Bonus check!

At the very least, it definitely sounds like something worth looking into.

7. Do A Credit Card Balance Transfer

I know there is some debate over whether transferring credit card balances is really worth it.

And in my humble, debt-free opinion, the answer is a resounding… ABSOLUTELY!

It helped me tremendously!

In fact, when I first started increasing my payments on that $19,000 credit card debt, the balance barely seemed to move.

Why?

Because the interest was eating away most of my payment!

Then, I saw a news report that talked about saving tons of money by doing a balance transfer. It also reported that many credit card companies offer 0% interest for 6 -18 months when you do.

That’s all I needed to hear!

So, I used a technique like the video from earlier in this post. And I was able to score a 0% interest rate offer! Yes!

Granted, there was about a 3% one-time balance transfer fee. But, it was a small price to pay when compared to the astronomical interest I was being charged every month.

Of course, it is possible that your credit card company may not provide you with a 0% offer. So at that point, you may need to cautiously consider applying for a card that will.

I said cautiously because that can be risky if you can’t control your spending.

In my case, I was able to get that 0% offer through one of my husband’s cards, without having to open any new accounts.

But, if push came to shove, I was definitely ready to open a new account if I needed to.

Because I was determined to stop throwing money away on interest! And, to finally get rid of my debt!

Here’s a link if you’d like some insight on how to choose the right card for balance transfers.

8. Boost Your Payments

I know you might be thinking, “how an I supposed to do that with no money?”

And I totally understand the feeling!

When my kids were little, I only worked part-time. So I barely had enough money to pay the minimum, not to mention anything extra!

Now, during that time, I did try out a few different side hustles to earn more money. Although, that’s not what they were called at that time.

I’ve sold cosmetics, energy services, crystal, and some other wacky things too, no doubt.

However, I still didn’t earn enough to make even a small dent in my debt!

Truthfully, I really wasn’t able to start making significant money until my kids were in school. That’s when I was finally able to get a full-time job and increase my income.

From then on, I started throwing as much money as I could at my debt to pay it off as quickly as possible!

Now, I know many of you moms still have small children and daycare issues. So working full-time may not be a workable option for you right now.

So what can you do to improve your finances?

Fortunately, these days there are so many amazing side hustles to choose from! Things that I had no idea about when my kids were little.

Of course, starting a blog is one of them! However, it won’t put steady cash in your pocket right away. But, if it’s something that you’re considering, then use my post on How To Start A Blog The Right Way In 7 Easy Steps to guide you.

In the meantime, you probably need a more guaranteed source of income for now. But, you also need a flexible schedule. Then consider trying VIPKids.

I’ve heard nothing but fantastic things about them!

And, I’m even starting the application process myself. I can do this to help supplement my income while I’m growing my blogging business.

Just take a look at this quick video about how easy it is to earn money with VipKids.

Cool, right?

So basically, you would be teaching kids in China how to speak English.

You get to choose your own hours! And make a decent income! While still working from home!

And the best part is…that you don’t have to speak Chinese to do it! Brilliant!

The Takeaway

Well, there you have it moms!

These are some of my tips to help you get out of debt when you’re feeling stuck!

I know they can work because they worked for me! But of course, everyone’s situation is different!

So just to reiterate, the most important things I can tell you is that you need to:

- Stop spending

- Acknowledge how much debt you have

- Communicate with your spouse

- Be realistic about paying down debt

- Refinance student loans

- Get mad and attack your debt

- Ask for lower interest rates

- Do balance transfers

- And increase your payments

Doing these things will help save you from the turmoil of dangling on the financial edge. And, provide you with a sense of having more control over your finances.

I did it! And so can you!

So, are you feeling stuck and lost with your finances? If so, tell me your thoughts! I’d love to hear from you!

Great article! I’m not a mom but I think anyone in debt can use these tips…I know I can use all the help I can get for getting out of debt and cutting down wherever I can. These are great tips and I especially like the “communicate with your spouse” part, because if you’re not both on board it can be very difficult to tackle your goals and get there sooner. Thank you for such helpful advice! I definitely have a different view on credit cards now! Lol!

LOL Kari, your comment about using all the help you can get makes me smile! And these tips can absolutely work for anyone!

I love this post… it’s a realistic view of how to pay off your debt in a way that could actually work!! Thank you!!

Thanks so much! And you’re right, it is very realistic. I don’t like to give people false hope but more of an “it can be done.” sort of mentality! I know everyone wants to get out of debt instantly. But just think, if you start today…in 2 years anyone could be! Or at least be that much closer.

This is a great post for anyone who’s in debt. One thing I’ve been focusing on lately is the stop spending part. I was wasting a lot of money eating out so I started cooking more. Doing this I was able to save more money and put it towards other things. Thanks for the helpful advice. 😀

Thank you so much for your comment! It’s easy to waste money on eating out because of the convenience. But, it’s heck on the wallet!

Awesome tips DeShena. They are perfect for everybody.

Thanks, and you are correct. These tips can absolutely work for anyone in debt!

Simple and doable steps to get out of debt. I like how put spending at the top of the list. It is the crucial point in the moving towards debt free journey.

I 100% agree! You’ll never get out of debt if you keep spending. I learned from experience. Thanks for reading!

there are some really good, realistic ways to pay off debt here! Love this post, more people need to read this.

Thank you so much! Glad you found it useful! 🙂

We moved recently to a much more expensive part of the country and we are trying so hard to clear out that moving debt that always seems to build up! I hadn’t thought about transferring balances. I will need to do some more research there!

Yes, definitely research it!

Because when you have no interest the money goes straight towards paying down the balance. And watching the balance get smaller and smaller at a faster pace is exciting! It keeps you motivated and you know you’re making progress. I literally saved thousands of dollars in interest just by doing balance transfers and then paying off the debt within those timeframes.

I found that my problem with the lavish “Kid” parties wasn’t the fact that my kids might care about the quality of the shindig but rather that I would be JUDGED by the Other (perfect) parents just #winning at life! I now know that, if you surround yourself with people who love you, no one else’s opinion matters. Deep breath… cut up the cards!

You are absolutely correct Anna!

In fact, I almost added that comment to the article but decided to save that for another post. The truth is that often the parties are more for the parents than the kids. Because we all want to look like we are the perfect parents and doing everything perfectly for our kids. But, I gave up on trying to impress other people years ago. And that has saved me soooo much money, lol!

These are all fantastic ways to help get out of debt, I find it can be difficult if your in a relationship when both parties are not on the same page on getting this done. However, very helpful information nevertheless!

I agree that relationships and money can be tricky! That’s why communication and not hiding debt is crucial for a successful one

Such great tips. I definitely need to refinance my student loans.

Thanks, and that can definitely go a long way towards saving money!

Some excellent ideas for people in debt. Being in debt can be extremely stressful so talking to your partner about it can definitely help.

I absolutely agree! Thanks for reading!

Open communication is very important for the couple to settle their debt early.

Absolutely! Communication early and often!