Health or money, which would you rather have more of? You’re probably thinking, I need more of both, right? The problem is that gym memberships, exercise equipment, and healthy food seem to cost an arm and a leg. And if you’re already in a money pinch, then it’s easy to feel like you just can’t AFFORD to be healthy.

I totally get it! However, have you seen the cost of healthcare to treat chronic diseases and illnesses? Talk about a real money pit!

So, wouldn’t it be great to be able to reverse, or better yet, prevent health issues before they start — annnnd, get out of debt at the same time?

Well, here’s a little secret…shhh! In part eight of my Empower Series, I spoke with nutritional experts, John and Rosemary Fotheringham, who have succeeded at both! And the best part is, they’re sharing 34 eye-opening ways they were able to overcome their own health struggles while still paying off a ton of debt.

So pay close attention, and let’s dive in!

Watch the full video here. (Text has been mildly edited for readability.)

Related Post – Part One: The Best How To Budget Advice From A Self-Made Millionaire.

Related Post – Part Two: How To Overcome A Crisis And Still Achieve Financial Independence.

Related Post – Part Three: How To Conquer Money Challenges and Improve Your Finances Now.

Related Post – Part Four: How This Mom Slayed $1 Million Of Debt In Under 3 Years.

Related Post – Part Five: How To Master Self-Care And Money During Stressful Times.

Related Post – Part Six: How To Navigate Money, Retirement, And Entrepreneurship, The Smart Way!

Related Post – Part Seven: How To Strengthen Your Marriage, Money, And Mental Health.

Related Post – Part Eight: How To Achieve Better Nutrition, Health, And Finances

Table of Contents

So tell me about your background?

Rosemary: So, we are both functional nutritional therapy practitioners. And when we started getting out of debt, we found the FI (Financial Independence) community. We read everything we could get our hands on and listened to every podcast.

So, we ended up getting out of debt and reducing our grocery bill. Before we started, we were doing like $1,200 a month on groceries for the two of us. And then, [#1] we cut that in half. And then we cut it in half again. We were still able to eat real food and not just rice and beans.

John: Yeah, we had this same kind of exciting allure to the FI (Financial Independence) community, as we did when we first got into nutrition. It’s kind of like falling in love again with a new world.

DeShena: So you were able to cut your grocery bill from $1200 to $300 a month?

John: Yeah, when we were getting out of debt. Now I would say it’s probably gone up to around $500 or $600 a month. But we eat grass-fed or grass-finished beef. Because to us, it’s a number one priority to eat nutrient-dense, properly raised and properly prepared food.

Rosemary: Our perspective is:

Pay the farmer now, so we don’t have to pay the doctor more later.

We don’t want to cut corners by just eating rice and beans and then have to deal with chronic disease later down in the future. That’s important to us and why we want to be able to teach other people to do the same.

John: We think it’s a false dichotomy that you can either eat well and spend a fortune. Or eat cheap and harm your long-term health.

How did you pay off debt?

John: I brought the debt to the marriage, or at least the vast majority of it. So, most of it was consumer credit card debt.

Although part of that credit card debt, I actually had accumulated paying for school. That was foolish! But I didn’t know what I was doing, and I still don’t, in many respects, (haha).

Anyway, when we got married, I believe we had $66,000 in debt, and we paid that off in about three years.

Rosemary: Yeah, [#2] we came across the Dave Ramsey book, and John was like, okay, let’s do this! And we kind of just put the pedal to the metal. Also, I think it was a system of [#3] refining [our expenses] as the months went on. For instance:

Things that we thought were needs, we actually realized they were wants.

So it kind of just became this fun game. It’s like, how can we get creative?

And saying things like, okay, we’re not going to the movies, [#4] but can we do a date night in? Let’s get a movie from the library and make fancy popcorn with grass-fed butter and truffle oil. And still, have a great time but not spend $30 on a night out.

John: That was huge! Finding that sweet spot between enjoying life in the moment, but also not overspending to carpe diem either. You know, another false dichotomy is the argument that either you live for the day, or you live for the future.

And I always thought — does it have to be either-or?

Can’t we figure out a creative way to enjoy the moments and enjoy the days? Because I think Mister Money Mustache talked about how a good life is really just a series of good days put together.

Creative Ways To Get Out Of Debt

Rosemary: We did a few different creative things. [#5] Some of the time, we lived with family. [#6] We did house-sitting full-time for six months while all our stuff was in storage.

[#7] We began throwing the money that we were saving on rent towards debt. And we were still getting to travel because travel is important to us. So we got to travel all over the US basically, which was fun.

So yeah, we used just like a lot of different strategies. Of course, there were times that were not so fun. But, such is the case with any hard thing.

Play Offense And Defense

John: I think the Dave Ramsey book was kind of the Gateway drug for me getting into this FI mindset. Until I read that book:

I always had the belief that I would never actually get out of debt unless I had some massive windfall.

For me, it was always about offense. And I do think that earning more is important, but you can’t just save your way to financial independence only.

I think you need both offense and defense. But I was stuck in the mindset that it wasn’t about the spending side. And I think that’s a really important Upstream checkbox because:

If you don’t get your spending under control, you’re never going to get [out of debt]!

Because what would happen inevitably is that I would get some kind of windfall. Then, I just would spend it all! Because I hadn’t changed that habit yet.

Know Your Partner And Don’t Push

So with the Dave Ramsey book, it was so funny the way it happened. Rosemary had gotten the book maybe as a gift, and it was on the coffee table and I just started reading it.

Now I don’t know if you’re familiar with Gretchen Rubin’s Four Tendencies? But, I’m what she calls a questioner. So if something makes sense to me, I can change very quickly! So I started reading the book and about halfway through I looked at Rosemary and I said, okay let’s do this!

So that’s important to any folks out there. If you are in a couple, and one person’s already FI or FI curious, and the other one is not, I really think it’s a good idea not to push it. [#8] You need to let them come to it on their own!

Rosemary: Well, I think even beyond that is just knowing your partner’s tendencies. So Gretchen Rubin, who came up with this framework, has a Four Tendencies quiz. [#9] And, knowing which of those Four Tendencies your partner is can really help to get that conversation started.

For Instance, if they’re the rebel type, it’s all about:

- You don’t want those credit card companies controlling you.

- You don’t want your employer controlling you.

- Don’t you want to be able to have the freedom to do whatever you want?

- Don’t you want to make your own decisions?

And if it’s a questioner tendency — it’s all about logic. And here’s the math. And in 10 years you can be totally financially free if you just do these things.

So, we found the framework really helpful. And I know people often have the question about how do you convince a spouse? I think that framework is just top-notch for that because it helps to frame how you bring up the topic in a way that appeals to them.

How do you convince a spouse to get out of debt?

John: I would say that phrase how do you convince your spouse, is problematic from the beginning.

I don’t think you can — or should try to.

[#10] I think the best thing you can do, first and foremost, is change with your doing! And they will see that.

For example, if you change how you’re eating and suddenly your body transformation is rapid and miraculous, they’re going to get curious about it.

And, if they see that you’re eating these delicious looking meals but not spending an arm and a leg, that could be very interesting. So the same thing applies with changing how you’re spending.

DeShena: My focus is always on mindset. See how you just had that shift? It’s like, okay, I’m ready to do this! But trying to push somebody doesn’t work. I think you’ve got to make that connection. And I think that’s what people are always searching for, the thing that makes sense to them. And it may not be any different than what they’ve already heard, but it may be framed a different way.

How does nutrition, health, and finance work together?

Rosemary: So I think we realized that there was nobody talking yet about sort of a functional approach to nutrition. Or, the connection between the food you eat and your health.

At the same time, we saw so many people worried about the unknowns of healthcare and early retirement. You know, how can you know if you’re going to get sick?

I think before I understood about nutrition, I just thought getting sick was bad luck.

And it doesn’t matter if you’re rich, poor or whatever. It’s totally out of your control! It’s in your genetics!

But, as we’ve learned, the way that you live your life, for instance:

- Your lifestyle

- How you eat

- How you exercise

- Getting sunlight

- Stress management

- How you sleep

They ALL impact your health and your risk of disease.

[In other words,] I’ve heard it said that:

Genes load the gun, but lifestyle pulls the trigger!

So there’s so much you can do with lifestyle. And even if you do have a genetic predisposition to something, it doesn’t necessarily mean that you’ll end up with that disease.

And so we realized that there needs to be somebody who can teach people how to live and eat in a way so that the health care issue is not so scary. And, so that it reduces their risk of future disease.

But if they’re already dealing with a chronic disease, [teaching them] ways to kind of reduce the burden of their body. And to reduce the extent of the symptoms they are experiencing.

Getting Control Over Your Health

John: We’re not saying that you have 100% control and that you can completely prevent disease. But, we do think there’s a lot you can do to increase the size of your locus of control.

Rosemary: I should say both of us have struggled with health issues for years that changed completely when we changed how we were eating.

And so we’ve seen the power of that in our own lives, in our clients, and in classes that we’ve taught before. We see how people and their bodies are just able to get it into gear when they’re giving the right building blocks.

This stuff works!

So we really wanted to be a voice to advocate for beyond rice and beans, and really prioritizing health. Because:

If you don’t have your health, how can you enjoy your 30 or 40 Years of early retirement?

So that was kind of our intention with our focus.

Misunderstanding Health And Wealth

John: One of my favorite philosophies came from a student when I was teaching English in Taiwan. He was a very wealthy guy and he said that:

‘Health is a ONE and money are zeros.’

It doesn’t matter how many zeros you have after that one — if you don’t have the ONE — it’s just zeros.

So only having wealth and no health is useless!

That’s always stuck with me. And we do see that a lot in the FI community and in the World At Large.

There’s this idea that it doesn’t matter so much what you eat now, just focus on spending as little as possible on everything.

And we see that as being problematic. Because something like rice and beans, people will say if you combine them together, you create a complete protein. And that is theoretically possible in Biochemistry.

But in the actual practice of how the human body works, that is a highly inefficient process.

And also, that depends on your digestive tract being perfectly healthy and working properly, which is often not the case.

And so our whole thing is about making sure that what we are putting into our mouths, in the beginning, has as many of the important nutrients that you need to survive and thrive as possible.

And at the same time making sure that your gut and your digestive tract is as healthy as possible.

And unfortunately, things like rice and beans actually can cause damage in some people to that tract.

Can you explain what the functional part of nutrition means?

Rosemary: So essentially, when we talk about a functional approach to health care, it’s in contrast to an allopathic approach.

So what it comes down to is that an allopathic approach is sort of our traditional medical model, which is essentially relief care. In other words, you’ve got symptoms, so we’re going to treat the symptoms.

The problem is that people get stuck in this endless loop of treating symptoms. For instance, you take a pill, and then you’ve got these other symptoms. Well, don’t worry, we’ve got a pill for those symptoms too.

And those symptoms really are not normal. They’re a sign that something needs to be resolved.

So in contrast you have kind of a functional model which some people call the 21st century model of medicine. Basically, you’re addressing the root cause upstream.

And since you’re addressing symptoms further Upstream, then the symptoms kind of naturally or generally go away. Because you’re getting to the root cause.

Case in point, if you’ve got acne, you may never realize that it’s very connected with your gut. So people will put on topical stuff. And they never think, oh, maybe something’s going on with digestion and absorption of nutrients. And it’s just showing up on my skin.

So the functional model is really more about the lifestyle, diet, exercise, getting the right nutrients, sleep, movement, and that sort of thing.

Getting Your Body In Balance

John: I’d also add how often the allopathic or symptom-based model is often thought about as [treatment from the] outside in. So putting things on your face or taking a pill, it’s very much about I need to take this for this.

Whereas the more functional holistic model is more about [treatment from the] inside out.

Rosemary: It’s also about asking questions. Like, why is that happening? And when did that start?

Your body is always looking to find a state of balance. We call this homeostasis.

And your body’s default is health!

But it’s only when it doesn’t have the right building blocks, or it’s challenged with stressors beyond what it can match that things start to get out of balance.

So, by reintroducing certain foods, habits, or better sleep, then the body can better reach that state of homeostasis and sort of balance itself out.

And as it does, that’s when people notice their symptoms start to get better or go away altogether.

However, I want to be really clear that neither of us are licensed practitioners. Our role is supporting the body to do what it does naturally. And working on bringing balance.

If somebody’s already at a disease state, of course we’d be recommending that they work with a licensed functional practitioner. And our work would help support that.

But we aren’t doing any diagnosing or treating. All we’re doing is coaching lifestyle, behaviors, and habits. And the body does [the rest!]

DeShena: Wow, that is so amazing! I totally understand that people don’t get it. But they don’t know! Like you said, with genetics, everybody thinks I’m just predisposed to get that. But, it was so eye-opening to me to find out that we can actually turn genes on or off just by what we eat.

Doesn’t eating healthy cost too much?

Rosemary: I will say that it does not have to break the bank at all!

I mean, we were able to get our grocery budget down from $1,200 to $600. And then down to $300. And we settled on a number that’s a little bit higher.

But, that’s because health is a prioritization for us. But, it doesn’t mean that we’re blowing all our money at Whole Foods or whatever. Again, there’s ways to do things creatively and a little bit differently than most people.

The Best Ways To Shop

So, one big thing that may be obvious to some people but not to others is just thinking about where you shop. You can get good deals by [#11] getting things from local suppliers and [#12] buying in bulk.

So we actually get meat bulk from a local farmer. We recently bought like a quarter cow that [#13] we split with some family.

Buying things in bulk at Costco is great! On our website flourishfundamentals.com, I created a sort of FI healthy shopping list.

So there’s a whole list of stuff that is at Costco, stuff that we recommend that has clean whole ingredients. Read your labels!

Also,[#14] think beyond your traditional supermarket. Some of my favorite finds are from the local Asian store, for example. And I can get really good staples there for cheap. And I love supporting local.

So I guess in summary, buying things in bulk, [#15] buying things in season, and [#16] buying locally.

John: Also, I will say on the meat front that [#17] doing ground meat instead of steaks or other cuts tends to be a lot cheaper.

Pro-Tip To Reduce Waste

Oh, and [#18] reducing food waste is huge! Let me tell you a little trick that I learned about the term triage. Triage is figuring out what item is the highest priority that needs to be addressed first.

So some people will [#19] use a triage box in their fridge, which means to eat this first. Because this is about to go out of date or go bad. [Here’s what to do:]

- [#20] Use a clear plastic bin.

- [#21] Label it “triage box” or “eat me first.”

- [#22] Put the bin front and center where you can see it and won’t forget about it.

So much of where a lot of people don’t think about saving money on groceries is with food wastage. And I’ve heard statistics like 40% of the food produced in this country goes to waste. Which is just insane!

It’s not just the money. It’s also a huge producer of things like the gases that contribute to climate change and that sort of thing.

Use A Red Carpet Approach To Healthy Choices

John: You can prioritize eating the kinds of things that are on plan for you. Make those things very visible and easy to get to.

And then the stuff that you want to eat less of, [#23] put that up on a high shelf or in an opaque box. So you’re basically using the strategy of red carpets and velvet ropes.

Rosemary: The idea of the red carpet is like you’re making it really easy for yourself to do the habits that you want to do. And with the Velvet ropes is sort of putting in gentle barriers to keep you from doing those things you don’t want to do.

What about buying groceries online?

Rosemary: Oh, yes, yes! For a while, we were doing Walmart pickup or Instacart. The beauty of doing grocery delivery is, first of all, [#25] you never go into the store, which is nice.

But the big thing is that [#26] you can just get what’s on your list. So you don’t impulse buy the same way you do if you’re in a store.

And, as you’re filling up your online shopping cart [#27]you can see the tally of how much money it’s going to cost. So instead of getting up to the register and being like, yikes, that’s $90 more than I expected! You can look at that list and decide, [#28] what do we need to remove from the cart this week?

So again, it’s budget triage. So I highly recommend shopping online and getting your groceries delivered. It really is worth the fee.

John: Another thing to do is [#29] always have a defrost bowl. So we’ll buy meat in bulk and then put it in our deep freezer. But the problem is that if you’re not remembering to defrost that meat when it comes mealtime, you don’t have anything ready to go.

Then, you’re more likely to eat something off-plan, order out, or go out to eat. So having that bowl always there, and if it’s empty, then you know, okay, I need to put something back into the defrost bowl. Now when you’re ready to cook next time, there’s something waiting.

That was a trick that we got from another fellow functional nutritional therapy practitioner friend, Stephanie. Shout out to Stephanie!

DeShena: Shout out to Stephanie! That is a good trick because I’m guilty! I’ve been there! It’s an hour before dinner. and nothing’s ready. So it’s like now what am I going to do? And it’s so easy to pick up, have something delivered, or go to the drive-thru.

Shop Your Fridge And Pantry First

John: That’s something we definitely did when we were getting out of debt. We would always try to use up everything we had before we bought something new.

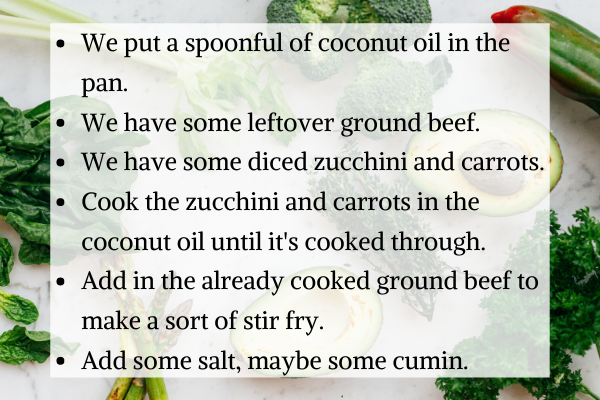

Rosemary: Yeah, and sometimes it takes a little creativity. But honestly, some of the best and simplest dinners that we’ve done is to grab a protein, grab a vegetable, and some healthy cooking fat.

Here’s an example:

Boom! Dinner — 10 minutes max!

Healthy Cooking Template

So let me give you the template.

- Start with a solid cooking fat. So when we say solid, and what I’m going to say is probably going to surprise some people, but some great options are saturated fats.

So, bacon fat, grass-fed Tallow (which is beef fat), pastured lard (which is pork fat), ghee (which is clarified butter). Those are all ones that we sort of rotate and use.

So maybe half a tablespoon to a tablespoon of solid fat depending upon how much you’re serving.

- Throw in some sort of vegetable or two or three. Whatever you like, kale, or zucchini, or carrots, or whatever. Stir those until they’re cooked through.

- And then by doing a little prep ahead of time. If you have some already cooked chicken thighs, or some already cooked ground pork or ground beef, you can just throw that into the pan next.

Stir it all together and heat it through. And add some salt. Done!

John: And I think that prep part is really important because that’s another strategy of convenience. In other words, another red carpet helper here.

[#30] Once a week, just setting aside a few hours to prep all the stuff for the week. Cutting everything up, putting it in glass containers putting it into the fridge so you can see it.

[#31] And then pre-cooking all of your protein so that it’s just a matter of bringing them to temperature

Rosemary, yeah, if you spend that time to meal prep earlier on, then all you really need to do at mealtime is assemble and maybe reheat through.

DeShena: I love that template. People don’t know this, but I did your 30-day carb detox, which was really amazing for my health as well. And that’s one of the things I really loved, was that template. It’s so simple!

The Surprising Truth About Saturated Fat

Rosemary: I should probably address that a lot of people might be saying, well, why can’t I cook in olive oil?

- We would say that the fats that are saturated, meaning that they are solid at room temperature, are more stable. However, that doesn’t include margarine and Crisco, which aren’t real food.

In any case, stable means that they’re less prone to going bad. We call that oxidation. But when fats get exposed to light and heat, they’re more likely to become oxidized or basically going rancid. And that causes all kinds of inflammation in the body.

And then you have these monounsaturated fats like avocado oil and olive oil that are less stable. Not as unstable as the polyunsaturated fats, but still those are best for at the most low to medium heat. They are really best to just put on cold stuff like cut-up veggies or salad. We called them finishing fats.

- Then you’ve got the polyunsaturated fats, which are really delicate and should never be heated! So ones that are good options might be like flax oils. Or the ones that come in the refrigerated section in the dark bottles. They’re being kept away from heat and light.

- And then the fats you should always avoid are any vegetable oils. So, canola oil, grapeseed oil, soybean oil, peanut oil, etc.

The Marketing Scam With Cooking Oils

John: This kind of drives me nuts even to call them “vegetable oils,” that’s a marketing term. They’re seed oils. These are refined, industrial seed oils that have been put under massive heat pressure to squeeze out the oil.

And then they have to deodorize them, this is bad news and something you do not want. And to call something like canola oil “heart-healthy” is also marketing. And it’s a lie.

Rosemary: If anybody wants to read a great piece of investigative journalism into all of the shady stuff that went into convincing us that saturated fat is bad for us and that the canola oils are better for us, there’s a book called Big Fat Surprise.

And, also I’ve got a guide to fat. So if anybody wants that, just send me an email to Rosemary@flourish fundamentals.com, and I’ll send it to you. You can pop up on your fridge. It’s just a one-pager about fats to eat and fats to avoid.

Omega 3 or Omega 6, Which Is Better?

John: People hear a lot about omega-3 and omega-6. And those are both really important. But you want to definitely [#32] make sure you’re eating more omega-3 than omega-6. And that can be hard to do in the modern diet. This is one of the reasons why we advocate eating the way we do.

Omega 3 seems to be more of a one-to-one ratio, which is good. And one of the best ways to get those Omega-3s for example, it’s not necessarily adding in a fat. It’s getting them in their natural form.

So something like wild-caught salmon has those wonderful fats in them already. And again because those are so sensitive, this is another reason you don’t want to overcook your food either, especially fish.

Ideally, something like salmon you can do sashimi if you’re into that which I am. It’s like the raw salmon for sushi. That’s the best way to do that because then you are not damaging any of those delicate polyunsaturated fats.

What’s the number one tip to help people improve their health and diet in general?

Rosemary: Mine is to [#33] chew your food! John’s is [#34] cut out sugar! Both equally important.

Let me explain the reasoning for chewing your food.

So, in terms of health — everything starts with digestion.

And we think that digestion starts in the mouth. But it really starts in the brain. And with the sight of the food, and even the smell makes your mouth start to water.

So when you’re chewing, you are breaking down the food mechanically. And then when it gets to your stomach, it has more of a burden to break down that food further chemically.

Many things distract us from paying attention to our food. We’re on our phones, working at a desk, answering emails, or trying to wolf things down for lunch. So our brain doesn’t send the signal to our body to get ready food is coming, we need to get ready to digest this.

And so what happens is:

- The digestive function is impaired.

- You’re not fully breaking down that food.

- It might be sitting there in your stomach because it’s not acidic enough to break it down.

- You’ll get reflux and burping.

- Whole food particles that are undigested going through your small intestine create all kinds of problems.

It becomes a breeding ground for pathogenic bacteria, parasites, and all kinds of other stuff that have downstream ramifications.

So we always need to [improve the digestive process upstream].

And if you take one thing away, it’s to chew your food 30 times each bite. Like, it should be liquid in your mouth. Even if you’re having a smoothie, still kind of chew that and swish it around.

Because you’ve also got these enzymes in your saliva called salivary amylase that starts to break down the carbohydrate. So, you really want to let the saliva do its job and reduce the stress on our sweet stomachs.

Avoid Expensive Poop

John: And to bring this into the FI mindset.

Doing more of the work upstream…you’re going to get more bang for your buck!

Rosemary: Yeah, you don’t just want expensive poop!

In other words, you’re not [properly] digesting and absorbing this food you’re spending so much money on.

Two Foods That Stress The Body

John: So getting back to sugar and vegetable oils, I think taking those two things out is super important because they’re toxic!

I don’t want to mince words here, they are not doing you any favors. And they are in almost all packaged foods, which is another reason we advocate eating a whole, real food diet. Because you’re making sure those things are not in it at the beginning.

Rosemary: Suffice it to say, that they just cause stress in the body and stress suppresses your immune system. And that gives your body and absolute beating.

So if you’re trying to get healthier and reduce stress on your body, especially if you’re already immunocompromised, then reduce sugar, vegetable oils, and the foods that turn into sugar. So that’s all your bread, your pasta, and that sort of thing.

Sugar Is The Hidden Drug

John and Rosemary: Yeah, so when I say sugar, people think I’m talking about added sugar only. And that’s certainly a problem. But we call it sugar in waiting.

So that bagel on the counter, even if it’s “healthy whole wheat,” it’s still just a giant Snickers bar.

DeShena: John, I remember that you said what people don’t know is that sugar is a drug. And it’s addicting because it’s in everything! So we’re all addicted to it.

And when I did the carb reset and started cutting out sugar, I went through withdrawals! And that was so unbelievable because I’ve never done drugs in my life! And the fact that I found out that I was addicted to sugar and going through literal withdrawals. I mean, chills, headaches, lethargy — I couldn’t even believe it! So, I just wanted people to know how important that is. Sugar is in everything! And it’s a drug!

Your Body Prefers To Burn Fat

John: We should also say that yes, there are withdrawal symptoms from the sugar [detox].

And part of it is just your body learning to adapt to burning fat and ketones instead of just using glucose.

Because:

There’s this belief that the body can only burn glucose, and it’s the body’s primary fuel source. That’s actually not true!

What is true is that if lots of glucose is available that will be burned first!

But if you train your body to rely more on “beta oxidizing fat” for fuel, then it will actually get used to doing that. And then it’s actually a lot more efficient.

Rosemary:

- It’s a cleaner-burning fuel.

- You feel better.

- You’re able to go longer in between meals and not get Hangry.

- You won’t feel like you want to punch someone if you haven’t had a granola bar for 2 hours. It’s stable, which is really nice.

So what tools and resources do you guys recommend for people with their health and finances?

Rosemary: I would say if somebody is serious about cutting out the sugar, there’s this book called the 21 Day sugar detox by Diane Sanfilippo.

This is a really great diet if you’re wanting to get started. It’s like a 21-day program, and she has all kinds of great recipes in there. A lot of people have gone through that to get rid of the sugar and carb cravings.

John: I really like Wired to Eat by Robb Wolf. And we talked about sugar and all these things being addictive.

I think it’s really important to underscore the fact that the reason we crave sugar and especially carbohydrate, is because these things are very rare in nature.

And so our bodies evolved to kind of crave them because they were so rare.

And now they’re available 24/7 all year round. And so the problem becomes we over-indulging in them.

But it’s not your fault! You’re not lazy! You’re not a glutton!

Your body is doing exactly what it evolved to do.

Rosemary: It’s just that we’re in a mismatched environment.

How Money And Health Evolved

John: Our genes and our environment are no longer properly aligned. So to succeed now, to be healthy:

You have to engineer your environment to kinda go against the grain of your genetic expectations.

So you have to do all those things we talked about with the red carpet and the velvet ropes.

Because, if we just go by this idea of intuitive eating, that doesn’t work.

The things in our environment are ENGINEERED to hijack our cravings and our desires.

So, this is true not just in food or in health, but also in business and in finance, for example, with our impulse buys and things like that. You have to go against your impulses to [get out of debt].

Rosemary: Yeah, the marketing things are engineered to hijack your reason and make you think, oh, I want that thing! I need that thing to be happy!

In evolutionary biology, they talk about how we evolved in what’s called an immediate return environment, right?

So, basically like there’s that tiger trying to eat us, run away! There’s that hot girl, fill in the blank. There’s that food, eat that food!

But to succeed in terms of health, in terms of Finance, in terms of business, and all these things, we’re now in what’s called a delayed return environment.

For example, all the rewards come from compound interest over a long span of time.

And that’s true for your body, and that’s true for your portfolio, right? And so we have to evolve. And we have to kind of override the evolution to do things that are not intuitively easy.

What events or promotions or where can people find you?

Rosemary: So our website is flourishfundamental.com. You can send us an email through the contact form over there if you have any questions. You know, we’re both really happy to help and share our stories

I’ve actually written a guide called radiant reboot that is on my website. And that’s something that essentially walks you through a 30-day program yourself.

So it’s a step-by-step where I hold your hand the whole way. For example:

- Here’s how to clean out your pantry,

- Here’s the food to buy.

- Here’s the equipment you should use.

- Here’s where most people get stuck.

- Here’s how to overcome that.

So that guide is there, and it’s really comprehensive. It’s a digital download so you can get it instantly. And I really created that for anyone who wants to go through and start a 30-day clean eating program themselves.

Rosemary and John Fotheringham are Functional Nutritional Therapy Practitioners who teach people in the FI community about the preventative side of health care, covering nutrition, movement, rest, and stress management. They were able to resolve many health issues through how they ate, and now teach other people how to do the same. Rosemary and John are the founders of Flourish Fundamentals, where their mission is to teach people how to opt-in to self-care now so that they don’t have to be forced into disease management later.

Wow wow wow!

Super informative and helpful, thanks!

This is extremely helpful and informative! Such a great resource to revisit!

That is so cool that you guys house sat for 6 months! I’d like to hear more about that, how neat and plus what a great way to save up some extra money.

How cool that you did house sitting for six months. I’d love to hear more about that! I love that you saved so much money doing it too!

Great post!! Thanks for sharing great information!

Extremely helpful. I could really do with both health and wealth tips so this was written for me. Thank you. I am saving this

Wow. This has been saved in my bookmarks. What an incredible amount of info packed into this page!

Thanks, Kim! Yes, John and Rosemary have so much important and helpful information to share about health, nutrition, and finances. And what they shared in this post was a high-level overview that just barely scratched the surface. I know them well and there is so much more to learn. I’m glad you found it helpful!

I just learned so much! But, my favorite part is the quote that your health is 1 and wealth is zeros. Exactly! Thank you for this!

Great interview! Tackling debt repayment aggressively is always a good idea. In the US wealth = health, unfortunately, so the sooner you have financial fitness the sooner you can attain optimal health. Though, there are things you can do to minimize health costs like doing minimal equipment at home workouts instead of paying for a gym membership, cooking at home instead of eating out, etc. Once you have your finances set you can look at things like gym memberships and organic groceries.

Nathalia | NathaliaFit – Fitness & Wellness Blog